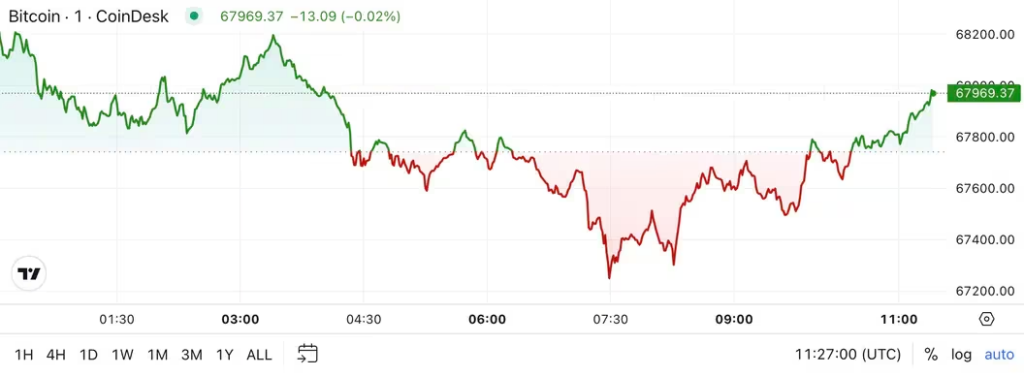

Bitcoin Market Update– Bitcoin’s recent trading range has settled between $67,500 and $67,900 after retreating from its peak above $68,000. Despite this pullback, BTC has maintained a gain of over 1.2% in the last 24 hours, outperforming many other major cryptocurrencies. In contrast, Ethereum (ETH) and Solana (SOL) have seen modest increases of around 0.75%, while Dogecoin (DOGE) has climbed nearly 1%. Overall, the digital asset market, represented by the CoinDesk 20 Index, has recorded a slight rise of just under 0.8%. According to data from CoinDesk Indices, Bitcoin appears set to close the week more than 1% lower, struggling to sustain its movements beyond the $68,000 mark.

In a significant corporate decision, the board of Microsoft has advised shareholders to vote against a proposal that would have the company assess Bitcoin as a potential hedge against inflation. In a filing with the SEC on Thursday, Microsoft outlined topics for discussion at the upcoming shareholder meeting. The proposal suggested that the tech giant explore Bitcoin for its potential to counter inflation and macroeconomic pressures. However, Microsoft pointed out that volatility is a factor to consider in evaluating cryptocurrency investments for corporate treasury applications that require stable and predictable investments. The company emphasized that it has established strong processes for managing its corporate treasury, deeming the requested public assessment unnecessary.

In Canada, Balance, a prominent crypto custodian, has achieved qualified custodian status this week. CEO George Bordianu expressed optimism about bringing the country’s ETF digital assets back home. He noted that many crypto assets backing funds from ETF providers like 3iQ, Purpose Investments, and Evolve are currently held in sub-custody arrangements with major U.S. exchanges such as Coinbase and Gemini. We have billions worth of retail assets in Canada’s crypto ETFs that sit in the United States, Bordianu stated in an interview. We’re trying to simplify the picture, to make it cheaper and a little bit easier for new asset managers to create more ETF and mutual fund options in Canada.

This evolving landscape highlights the ongoing dynamics in the cryptocurrency market and institutional responses, shaping the future of digital assets.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development