Bitcoin and MicroStrategy– Analysts from BitMEX Research have asserted that MicroStrategy is highly unlikely to be forced into selling its substantial Bitcoin holdings, primarily due to its current debt structure. However, they also acknowledged the inherent volatility of cryptocurrency, stating that anything is possible.

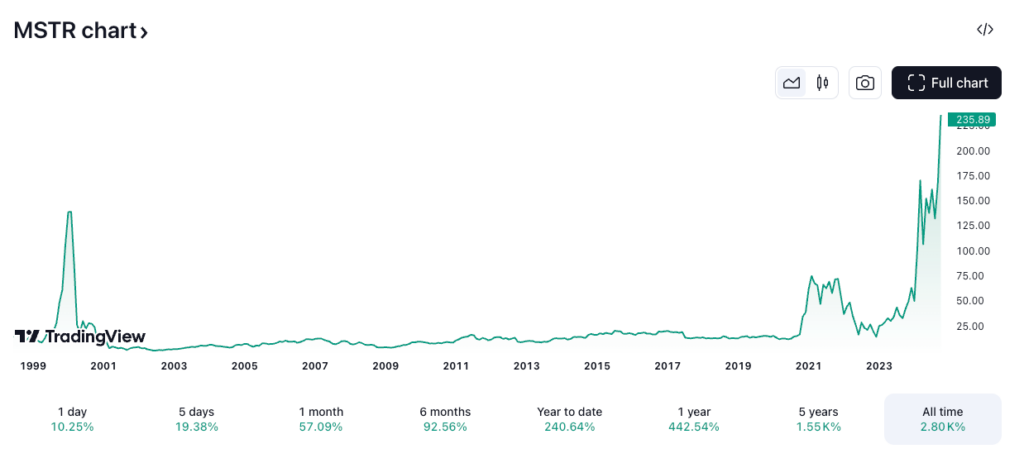

MicroStrategy stands as the largest corporate holder of Bitcoin, with a staggering 252,220 BTC valued at over $17 billion. This acquisition has been made at a total cost of approximately $9.9 billion. Recently, the company’s stock surged by more than 10%, reaching a 25-year high of $235.89, marking a significant milestone in its market performance. The firm’s market capitalization of $43.6 billion trades at a massive premium compared to the net asset value of its underlying Bitcoin holdings. This scenario is reminiscent of previous cycles with The Grayscale Bitcoin Trust before its transformation into a spot Bitcoin exchange-traded fund.

MicroStrategy has effectively utilized premium share issuances to fund further Bitcoin acquisitions, enhancing its book value per share through what some analysts describe as an infinite money glitch. Since adopting its Bitcoin strategy in 2020, the firm has raised a total of $4.25 billion across five equity offerings.

While MicroStrategy’s founder and Executive Chairman Michael Saylor has expressed no intentions of selling the company’s Bitcoin, the combination of significant holdings in a volatile asset and high debt levels raises questions about potential forced sales. BitMEX analysts highlighted that the bonds MicroStrategy holds come with intricate conversion options, allowing bondholders to either convert to MSTR shares or request cash redemption depending on various conditions, such as stock performance and bond maturity. Most bonds permit cash redemption if shares trade at a premium, while bondholders might convert to shares if Bitcoin prices are strong. This setup reduces the likelihood of forced Bitcoin sales.

Although interest payments on these bonds could pose a theoretical pressure on the company, the cash flow generated from MicroStrategy’s software business is expected to cover these costs, even in a declining market.

The analysts emphasized that MicroStrategy’s bonds are not a significant part of its capital structure at present, making forced Bitcoin sales to meet bond obligations unlikely. Even if Bitcoin were to experience a typical bear market drop of 80%, taking it down to around $15,000, the staggered maturity and bondholder options, which range from 2027 to 2031, mitigate immediate liquidation pressures.

However, if the market dynamics shift and MicroStrategy’s stock premium transitions to a discount while bond repayments come due, there could be a strategic advantage for shareholders to support Bitcoin sales. Currently, with the stock trading at a premium, the incentive to sell Bitcoin remains minimal. Nevertheless, an increase in debt could elevate the risk of forced sales during a Bitcoin downturn. For the moment, the leverage and liquidation risk appear to be low, providing a stable outlook for MicroStrategy’s Bitcoin strategy.

Analysts from BitMEX Research suggest that it is “highly unlikely” MicroStrategy will be forced to sell its Bitcoin holdings based on its current debt structure. While the volatility of cryptocurrency means “anything is possible,” the firm’s complex bond structure and cash flow from its software business should allow it to meet its obligations without needing to liquidate its Bitcoin.

If MicroStrategy’s stock premium over its net asset value shifts to a discount, or if bond repayments come due, shareholders may find it advantageous to support Bitcoin sales. Increased debt levels could raise the risk of forced sales during a downturn in Bitcoin prices, although analysts currently believe the leverage and liquidation risk are low.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development