The government intends to extend tax breaks for specific investments, including cryptocurrency investments, by the end of this year, according to a speech given today at Hong Kong Fintech Week by Christopher Hui, Secretary for Financial Services and the Treasury.

Hopefully, by expanding the availability of tax concessions to this wider scope of assets eligible under our fund regime and our family office regime, we will be able to add that extra impetus and pull to this Hong Kong market on their development front,

Hui

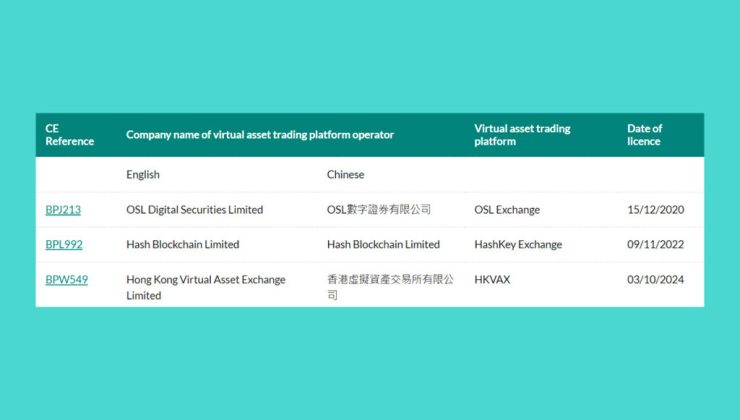

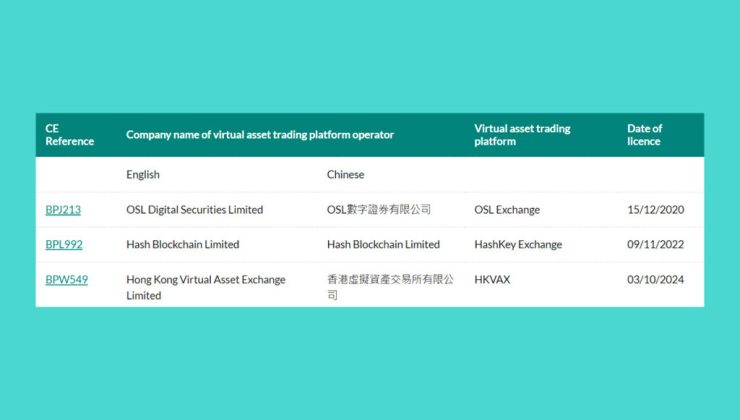

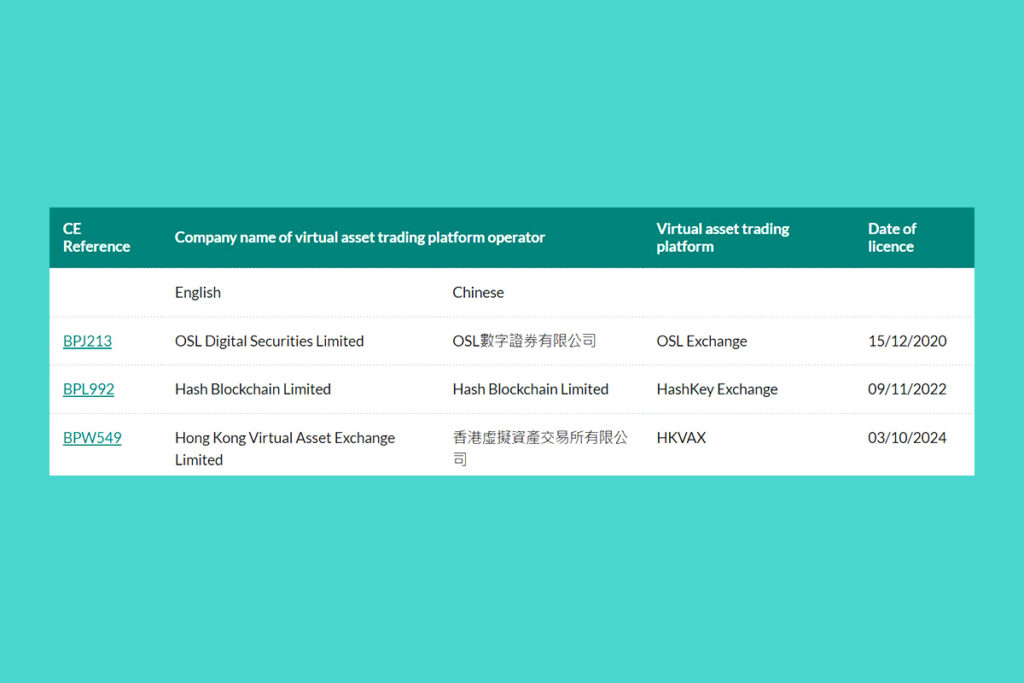

In the recent period, Hong Kong has extended a warm welcome to cryptocurrency companies. It formally launched a crypto licensing program for cryptocurrency trading platforms in June 2023, enabling authorized exchanges to provide retail trading services. OSL Exchange, HashKey Exchange, and HKVAX have received three licenses from the authority thus far.

The Securities and Futures Commission is actively reviewing applications for cryptocurrency asset trading platforms, and additional licenses should be granted in the coming months, according to Paul Chan, Hong Kong’s financial secretary, who spoke at the event on Monday. After the Hong Kong Monetary Authority (HKMA) launched its stablecoin regulatory sandbox in March, Chan stated that the HKMA, the de facto central bank of the region, also intends to enact stablecoin-related legislation this year. Before implementing the licensing system for crypto custodial service providers, the government will issue the second round of consultations next year, according to Chan, who also stated that the government is reexamining the architecture of the legislation governing over-the-counter trading.

For more up-to-date crypto news, you can follow Crypto Data Space.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development