Cardano (ADA) may be on the verge of a significant downturn, with one prominent crypto analyst foreseeing a steep 30% price drop. This bearish forecast comes just days after the Dubai Cardano Summit, where sessions highlighted the network’s ambitions to enhance blockchain security and functionality.

While ADA has seen a slight 0.4% gain in the last 24 hours, trading around $0.3344, its overall performance has been shaky. Cardano price is down 8.9% over the past week, with a 24-hour trading volume that has decreased by 14%, indicating weakened market momentum and a potentially grim outlook.

Crypto analyst Skinny recently called Cardano price trajectory “grim,” citing chart indicators that hint ADA hasn’t yet reached a bottom relative to Bitcoin (BTC) or Tether (USDT). According to his analysis, Cardano’s next support level lies near $0.23, suggesting a possible 31% crash from its current price. Interestingly, this bearish sentiment emerges amidst broader market optimism, with Bitcoin trading solidly above $67,500.

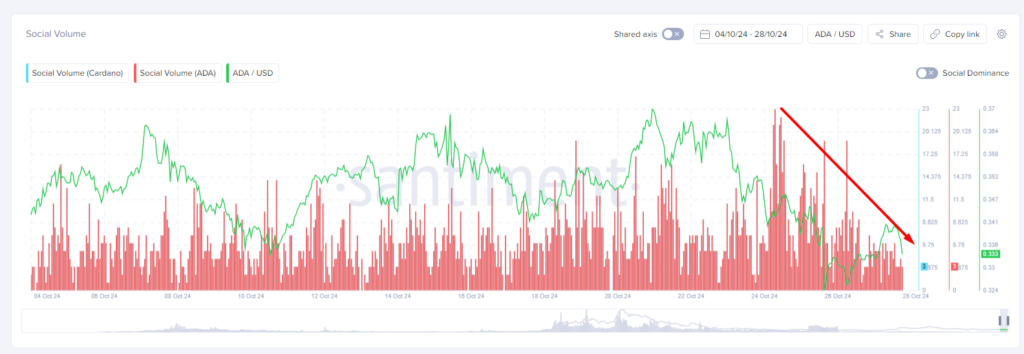

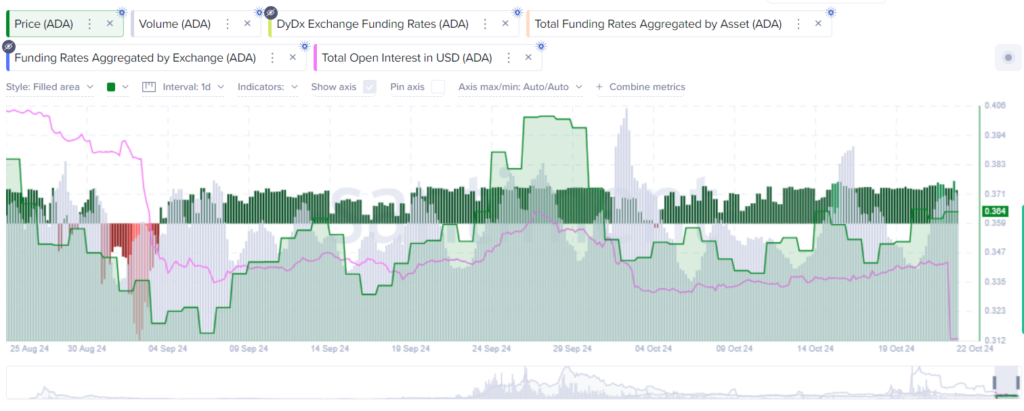

The overall market sentiment for ADA remains cautious, supported by data from Santiment showing a drop in ADA’s social volume since October 24, reflecting waning public interest. This lack of interest often foreshadows price declines, as seen in ADA’s recent trends. Cardano’s funding rate has also stagnated since October 14, while Open Interest (OI) recently hit a five-month low after the Buenos Aires Cardano Summit, where founder Charles Hoskinson shared his bold vision for ADA surpassing Bitcoin and Ethereum within the next decade.

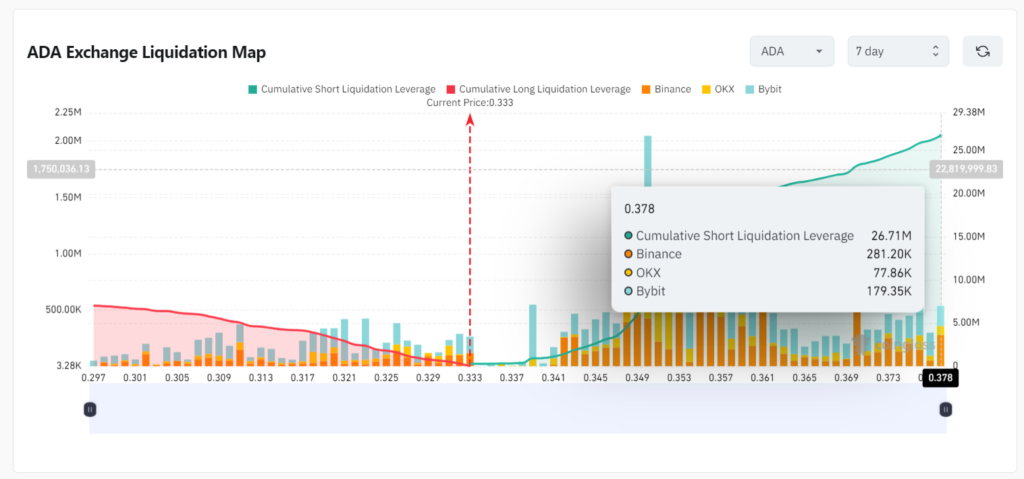

These metrics paint a picture of a volatile ADA market. The latest data from Coinglass’s Liquidation Map reveals a striking imbalance: ADA shorts ($26.71 million) outweigh longs ($6 million) by nearly four times over the weekly timeframe. This skew signals a bearish market outlook, with traders bracing for further downside.

Despite this bearish assessment, the Cardano community remains optimistic, with some analysts envisioning a potential price rise to $3, and more ambitious targets reaching $14 or even $16 in this cycle.

ADA currently finds itself locked within a three-month trading range, having tested resistance twice and support three times. Though the range-bound behavior could offer hope to some investors, on-chain metrics and trader sentiment lean bearish, hinting at a possible downside breakout. The primary support level is positioned at $0.31, a critical zone for buyers, while resistance at $0.37 and further at $0.41 could present hurdles for any upside movement.

Overall, the bearish outlook persists for ADA; however, should bulls succeed in pushing the price beyond the $0.41 resistance, ADA could rally to $0.45, countering the current bearish trend and signaling a renewed market strength.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development