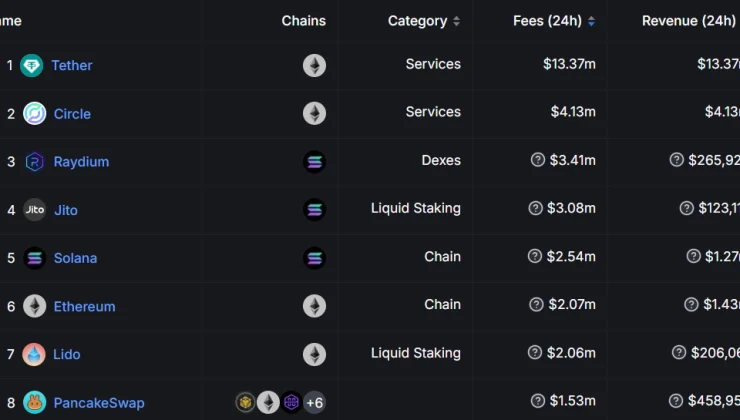

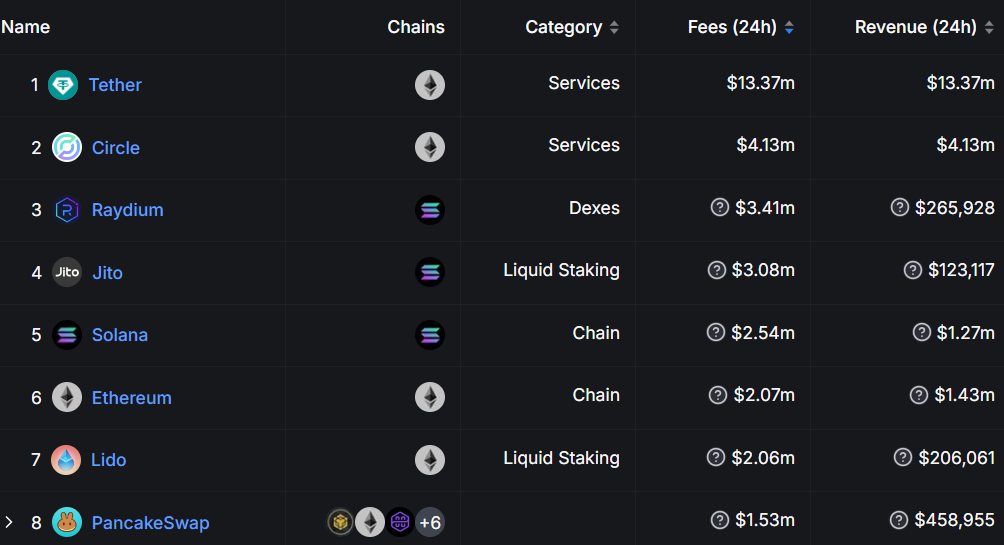

Crypto News – Solana has recently outpaced Ethereum in daily network fee generation, reflecting an uptick in user activity on the world’s third-largest blockchain. On October 28, Solana generated over $2.54 million in fees, surpassing Ethereum’s $2.07 million, as reported by DefiLlama data. This milestone has positioned Solana as the fifth-largest fee-generating protocol within the cryptocurrency space.

The increase in Solana’s fees is closely linked to heightened trading activity on its leading decentralized exchange (DEX), Raydium, which generated approximately $3.41 million in fees during the same 24-hour period. Solana is often labeled an “Ethereum killer” due to its monolithic scaling approach, aimed at boosting transaction throughput while minimizing fees without depending on layer 2 (L2) solutions.

In stark contrast, Ethereum’s fragmented structure relies on L2 solutions to achieve scalability. Critics argue that this structure disperses value away from the Ethereum mainnet to side chains, potentially affecting the overall efficiency of the ecosystem.

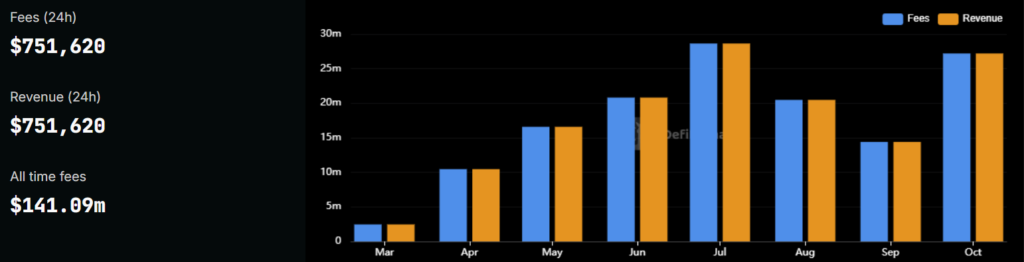

Despite Solana’s impressive recent growth, its transaction fees still lag behind Ethereum’s over a more extended period. In the past 30 days, Ethereum generated nearly $134.6 million in transaction fees, solidifying its status as the leading blockchain and the third-largest protocol by fees. During the same timeframe, Solana accrued $61.3 million in monthly fees, which represents about 45% of Ethereum’s total.

A notable portion of Solana’s monthly revenue can be attributed to activities involving memecoins. Specifically, over 47% of Solana’s monthly fees were derived from transactions on the memecoin launchpad Pump.fun, contributing roughly $29.5 million to Solana’s $61.7 million in total fees over the past month.

Interest in Solana-based memecoins has surged this year, with new memecoins attracting over $100 million in investments by March. However, crypto researchers have raised concerns about the overheated memecoin market, suggesting it may have reached “peak degeneracy” two months post the launch of Pump.fun.

It’s crucial to note that a staggering 98.6% of memecoins on Pump.fun fail to make it to Raydium, highlighting the risks associated with memecoin trading. This statistic underscores the volatility and unpredictability that often characterize the memecoin landscape.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development