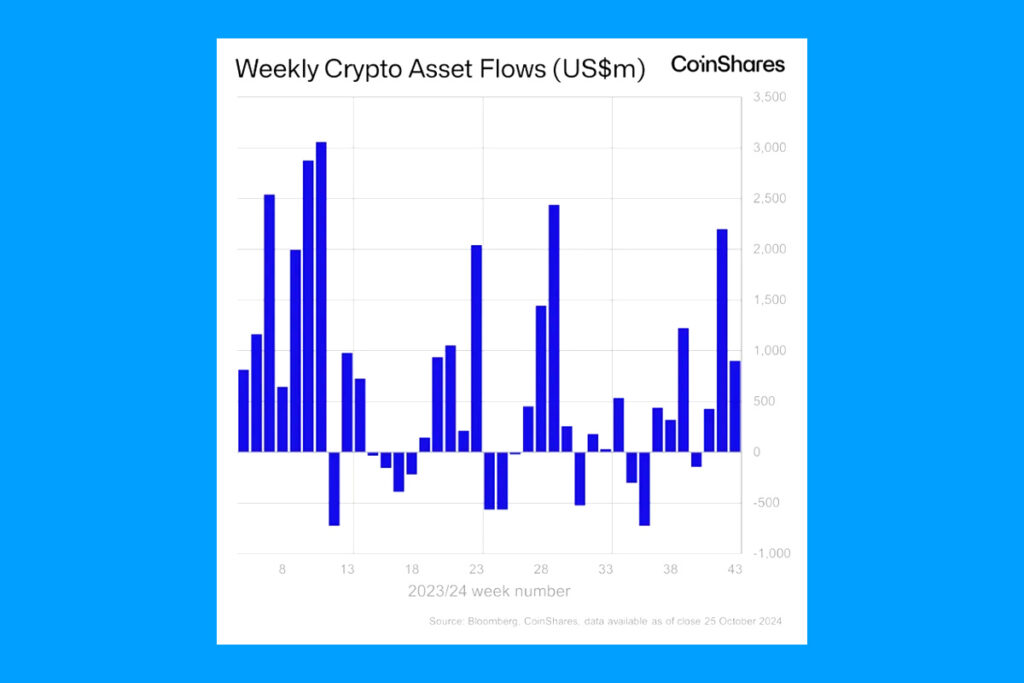

According to CoinShares, global crypto funds managed by asset managers like Bitwise, Fidelity, Grayscale, ProShares, 21Shares, BlackRock, and Grayscale saw net inflows of $901 million last week. October has seen the fourth-largest month on record, with over $3.36 billion flowing into digital asset investment products, or 12% of the assets managed by the funds. This has caused inflows to reach $27 billion so far this year, which is almost three times the record of $10.5 billion set in 2021.

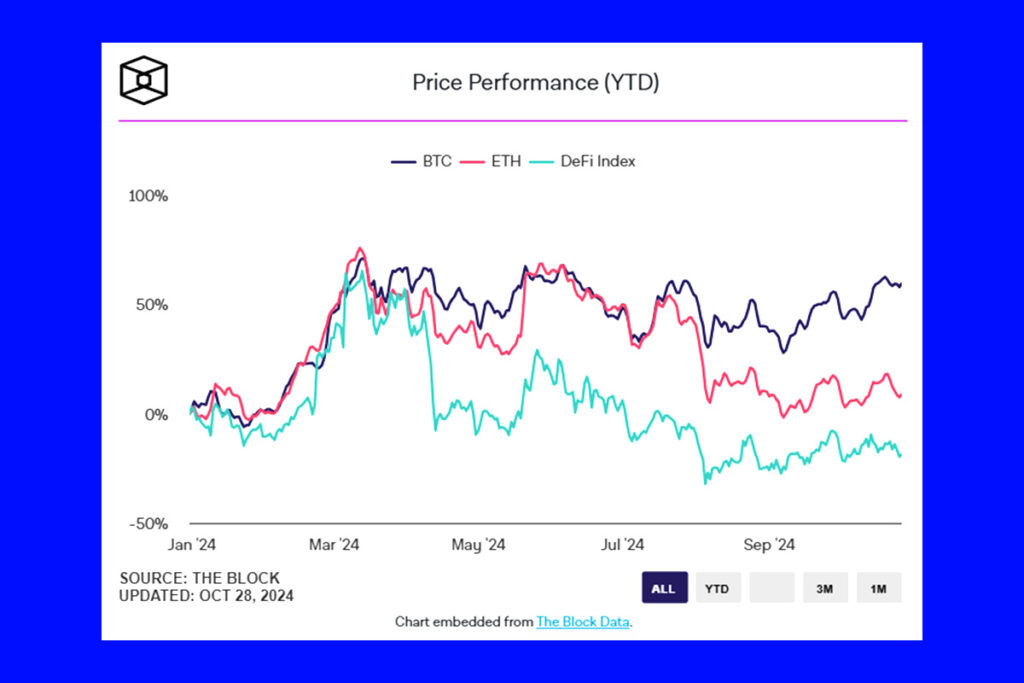

With weekly net inflows of $920 million worldwide, Bitcoin-based ETFs have almost taken over. There were also small net outflows of $1.3 million from short-bitcoin holdings. Additionally, Solana products and blockchain stocks saw weekly inflows of $10.8 million and $12.2 million, respectively. In contrast, the ETH/BTC ratio dropped to its lowest level since April 2021, bringing net weekly outflows of $34.7 million back to Ethereum-based funds.

Overall, U.S.-based crypto investment products generated $906 million in net inflows, with $997.6 million coming from U.S. spot bitcoin exchange-traded funds alone, topped by BlackRock’s IBIT. Nevertheless, funds based in Sweden, Canada, Brazil, and Hong Kong had a total of $29.1 million in net outflows, while other bitcoin-based products showed negative flows.

We believe that current bitcoin prices and flows are heavily influenced by U.S. politics, with the recent surge in inflows likely linked to the Republicans’ poll gains,

CoinShares Head of Research James Butterfill

According to the decentralized predictions website Polymarket, pro-crypto Republican Donald Trump is now leading Democrat Kamala Harris by 66.0% to 34.0% to win the Nov. 5 presidential election. Polymarket shows 84% odds of a Republican Senate, 52% odds of a Republican House, and 48% possibility of a Republican sweep, compared to 12% for the Democrats. The former president has also taken the lead in all six swing states.

For more up-to-date crypto news, you can follow Crypto Data Space.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development