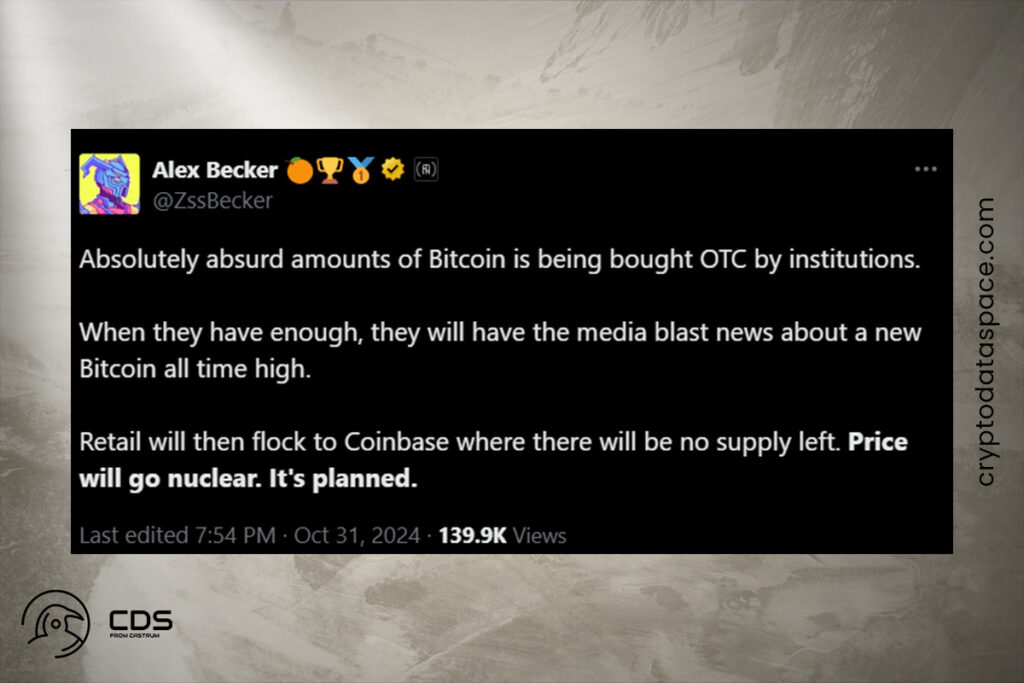

The price of bitcoin increased by 11% in October. Despite the fact that it hasn’t performed as well as some prior Octobers, traders believe a big price shift is about to happen as over-the-counter (OTC) exchanges compete for more Bitcoin. Crypto trader Alex Becker said on October 31 that “Price will go nuclear. It’s planned,” referring to the utterly ridiculous quantities of Bitcoin that institutions were purchasing over the counter.

When they have enough, they will have the media blast news about a new Bitcoin all-time high. Retail will then flock to Coinbase, where there will be no supply left,

Becker

According to a Cointelegraph story on October 30, Bitcoin is getting close to its record high of $73,679, which was established in March, but investors are not displaying any more interest than normal. Bitcoin search interest was merely a small portion of the traffic generated by artificial intelligence since October 23.

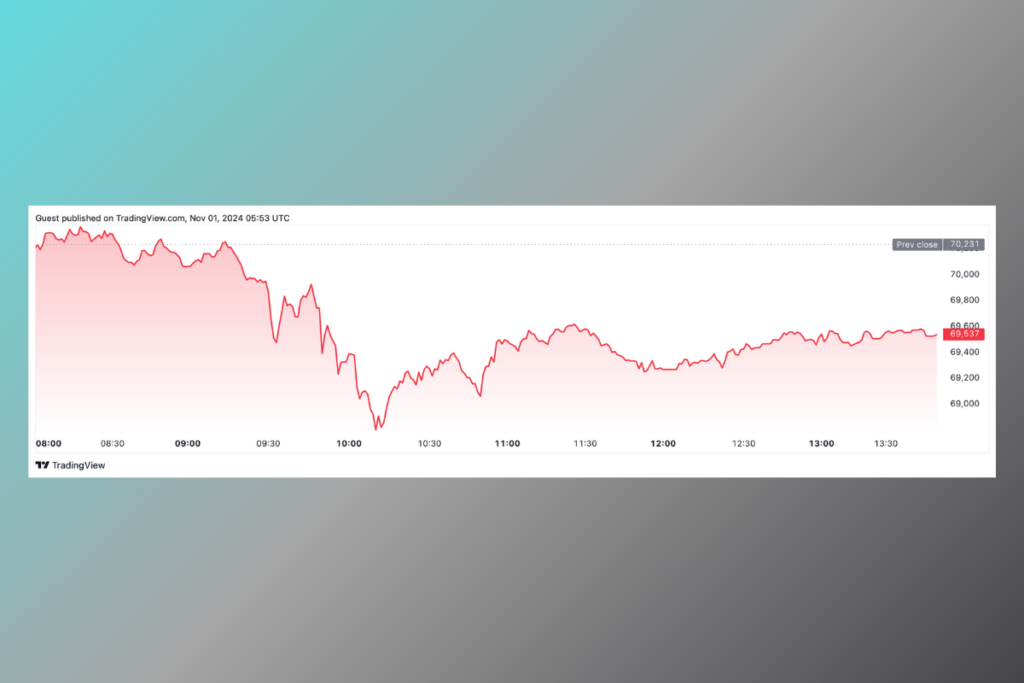

According to TradingView data, the price of Bitcoin increased by 11% from its October 1 start price of $65,634 to its October 31 closing price of $72,335. However, the performance is below its average rise of 22% for October since 2013. At the beginning of the month, there were concerns that this year’s Uptober might not go as planned, and it did.

For more up-to-date crypto news, you can follow Crypto Data Space.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development