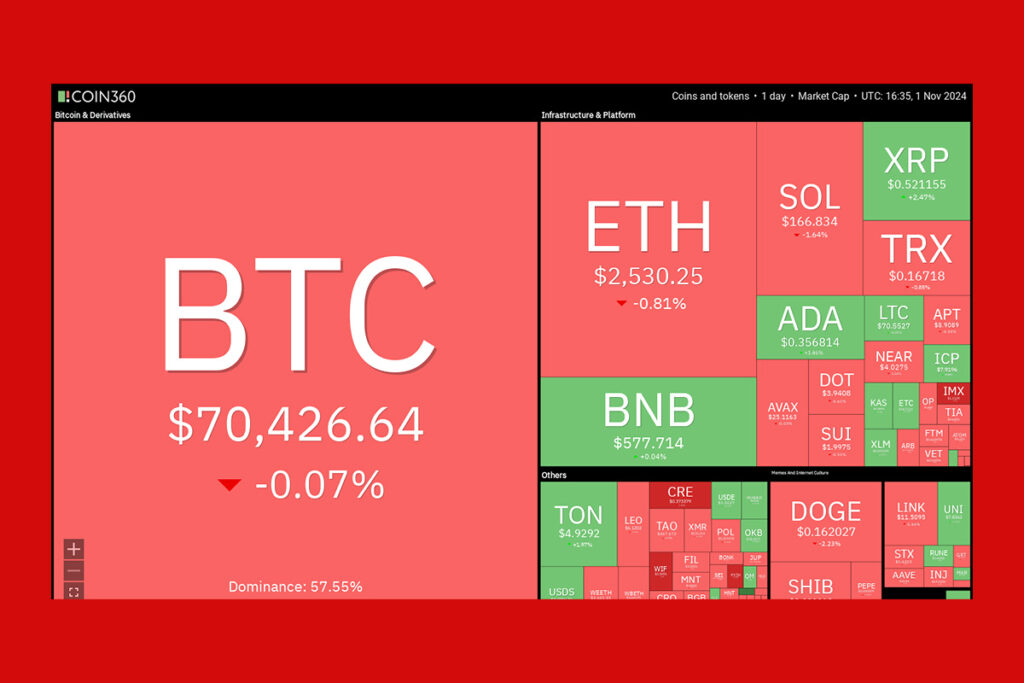

Bitcoin dropped below $69,000 on November 1, but the bears could not hold the price down. The bulls’ strong buying has caused the price to rise again above the $70,000 mark, suggesting that sentiment is favorable. As Bitcoin approaches its record high of $73,777, sellers will probably intervene. On October 31, 54,352 Bitcoin were delivered to cryptocurrency exchanges by short-term holders or organizations that retain Bitcoin for a maximum of 155 days, according to Glassnode data.

Long-term investors are looking for ways to increase the amount of Bitcoin in their portfolios, even as traders speculate about the cryptocurrency’s short-term price action. In order to purchase more Bitcoin, MicroStrategy announced plans to raise $21 billion in fixed-income securities and $21 billion in equity over the following three years.

On October 31, Bitcoin fell below the $72,000 support, then on November 1, it hit the 20-day exponential moving average ($68,132). The candlestick’s extended tail indicates strong buying close to the 20-day EMA. The bears resisted attempts by buyers to raise the price back above $72,000. A Doji candlestick pattern has developed on the BTC/USDT pair, suggesting that the bulls and bears are unable to decide.

Should buyers get beyond the $72,000 barrier, the pair might push past the record high of $73,777. The second leg of the upward rise may begin if there is a break and a close above this level. The pair might rise in the direction of the $93,554 pattern target. To erode bullish momentum, sellers must lower the price and keep it below the 20-day EMA. After that, the pair can drop below the $64,674 50-day simple moving average.

For more up-to-date crypto news, you can follow Crypto Data Space.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development