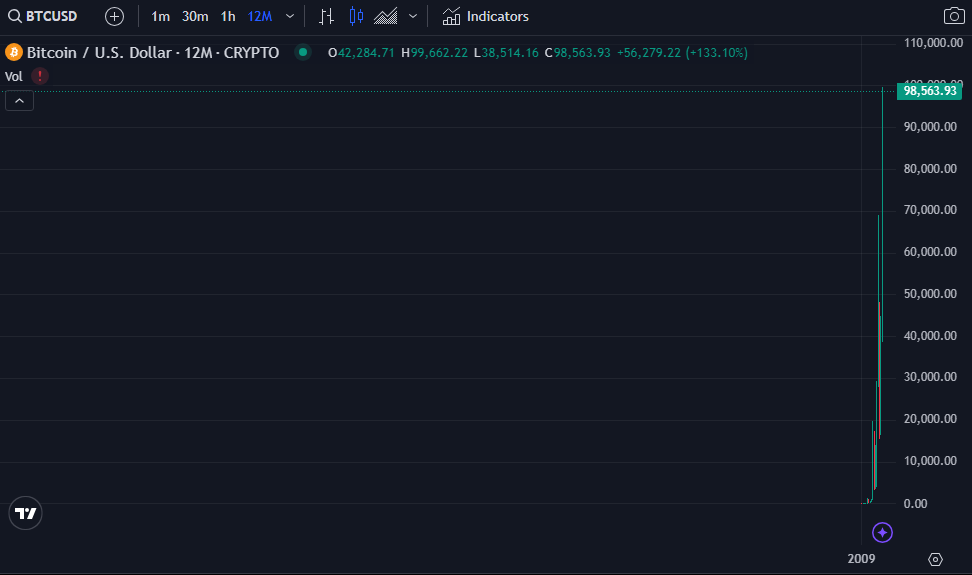

Bitcoin’s journey from a misunderstood digital experiment to a recognized financial asset has been nothing short of remarkable. As we approach 2025, the crypto world holds its breath, speculating about the future of Bitcoin price. Drawing on insights from top industry experts, market trends, and recent developments, this article delves into Bitcoin price projections, both optimistic and cautious, offering a comprehensive overview of what lies ahead.

The price of Bitcoin is more than just a number. As the leading cryptocurrency, it sets the tone for the entire market, influencing altcoins, institutional investments, and retail sentiment. Whether you’re a Bitcoin maximalist, Ethereum enthusiast, or altcoin investor, Bitcoin’s value often dictates the industry’s trajectory.

The upcoming years mark a pivotal moment for Bitcoin, as the market matures with increasing institutional involvement and regulatory clarity. Unlike past cycles driven mainly by retail speculation, Bitcoin’s price movements today are shaped by institutional investments, mainstream acceptance, and shifting geopolitical attitudes.

The approval of Bitcoin spot ETFs in the U.S. by the SEC in 2023 marked a watershed moment. With major players like BlackRock, Fidelity, and Vanguard offering Bitcoin-backed financial products, institutional interest has surged. November 2024 alone saw record inflows of $6.2 billion into these ETFs, underscoring Wall Street’s embrace of cryptocurrency.

The political landscape in the United States is evolving favorably for Bitcoin. Under the pro-crypto Trump administration, plans to make the U.S. a hub for digital assets include shifting regulatory oversight from the SEC to the CFTC and creating a Bitcoin Strategic Reserve. These developments bolster investor confidence and hint at sustained long-term growth.

The 2024 Bitcoin halving event has historically triggered price rallies, reducing the rate at which new coins enter circulation. With this scarcity mechanism in play, many experts believe the halving will catalyze Bitcoin’s next major bull run.

Several industry leaders and financial institutions offer optimistic projections for Bitcoin, supported by data and long-term market trends.

MicroStrategy’s Michael Saylor remains steadfast in his belief that Bitcoin will hit $100,000 by 2025 and continue climbing. Saylor likens Bitcoin’s volatility to the controlled chaos that fuels innovation, emphasizing its role in the asset’s growth.

Fundstrat’s Tom Lee predicts Bitcoin could soar to $250,000 in 2025, citing favorable U.S. regulations and potential government adoption of Bitcoin as a reserve asset.

Standard Chartered expects Bitcoin to reach $200,000, comparing its trajectory to gold’s post-ETF surge. The bank’s analysis points to robust inflows into Bitcoin-backed ETFs driving this price growth.

Venture capitalist Tim Draper is confident Bitcoin will reach $250,000 by 2025. He attributes this rise to its growing acceptance as a legitimate financial tool and store of value.

Not all predictions are bullish. Some experts urge caution, highlighting potential risks and market downturns.

“Rich Dad Poor Dad” author Robert Kiyosaki predicts a temporary crash to $60,000 before Bitcoin rebounds to $250,000 by the end of 2025. His outlook is shaped by anticipated market corrections and external economic pressures.

InvestingHaven suggests a bearish scenario where Bitcoin could drop to $75,000 if institutional momentum slows or unexpected regulatory barriers emerge.

Unlike previous cycles, which relied heavily on speculative retail interest, the current bull market benefits from foundational shifts:

Tim Draper and Tom Lee predict Bitcoin could reach $250,000 in 2025, driven by institutional adoption and favorable regulations.

Standard Chartered and Alliance Bernstein believe Bitcoin could exceed $200,000, fueled by ETF inflows and the 2024 halving event.

Bitcoin’s volatility stems from its limited supply, speculative trading, and evolving regulatory environment, which can lead to sharp price fluctuations.

The halving is expected to reduce Bitcoin’s supply growth, potentially driving demand and pushing prices higher, as seen in past cycles.

While many experts are optimistic, potential investors should consider market volatility, regulatory risks, and long-term adoption trends before investing.

Some bearish predictions suggest short-term drops, but most analysts agree Bitcoin’s long-term trajectory remains upward.

As 2025 approaches, Bitcoin’s price projection is a hot topic among experts and investors. With bullish predictions ranging from $100,000 to $250,000, the outlook reflects optimism rooted in institutional adoption, regulatory shifts, and historical market cycles. However, risks remain, from regulatory hurdles to unexpected market downturns.

Investors must navigate this dynamic landscape with a mix of caution and confidence. Bitcoin’s inherent volatility continues to make it both a high-risk and high-reward investment. Whether Bitcoin soars past $200,000 or faces temporary setbacks, its role as a transformative financial asset is indisputable.