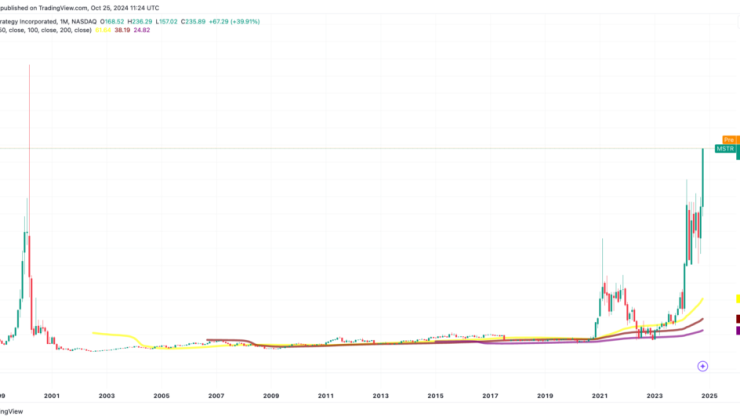

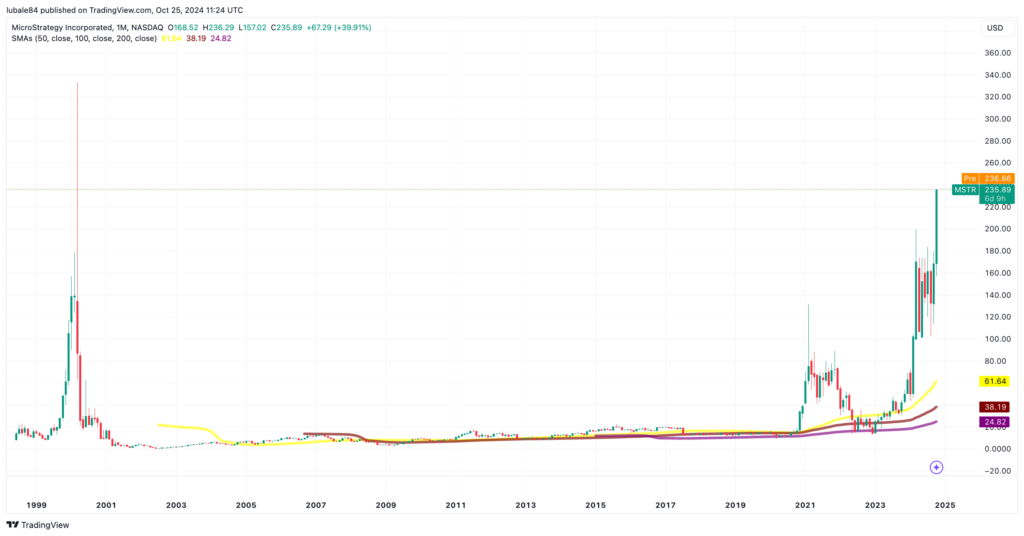

MicroStrategy Stock – MicroStrategy Inc. (MSTR) experienced a significant surge in its stock price, rising over 7% on October 25, reaching a remarkable $236. This increase marks a new 25-year high for the software company, which is the world’s largest corporate holder of Bitcoin (BTC).

This price increase continues a six-week rally for MicroStrategy, whose shares have now outperformed those of tech giant Microsoft. The software company’s stock gains come as Microsoft prepares to vote on a proposal regarding the potential addition of Bitcoin to its balance sheet. Crypto community commentator, Crypto Coin Coach, remarked, “MicroStrategy is soaring to a new all-time high! Crushing every company without Bitcoin on their balance sheet.”

Over the past five years, MicroStrategy’s stock has outperformed every company in the S&P 500 index, driving expectations for sustained bullish momentum due to its substantial Bitcoin holdings. Historically, MicroStrategy has outperformed Microsoft since its Nasdaq listing, with its shares rising approximately 1,570% compared to Microsoft’s 1,467% increase. This remarkable performance has been largely attributed to MicroStrategy’s aggressive Bitcoin acquisition strategy, initiated in 2020 when revenue from its software business began to wane.

In its most recent acquisition, MicroStrategy purchased approximately 7,420 BTC for around $458.2 million in cash between September 13 and September 19. This acquisition brought the company’s total Bitcoin holdings to 252,220 BTC, valued at nearly $17 billion at current prices. This amount represents over 1% of all Bitcoin that will ever be mined.

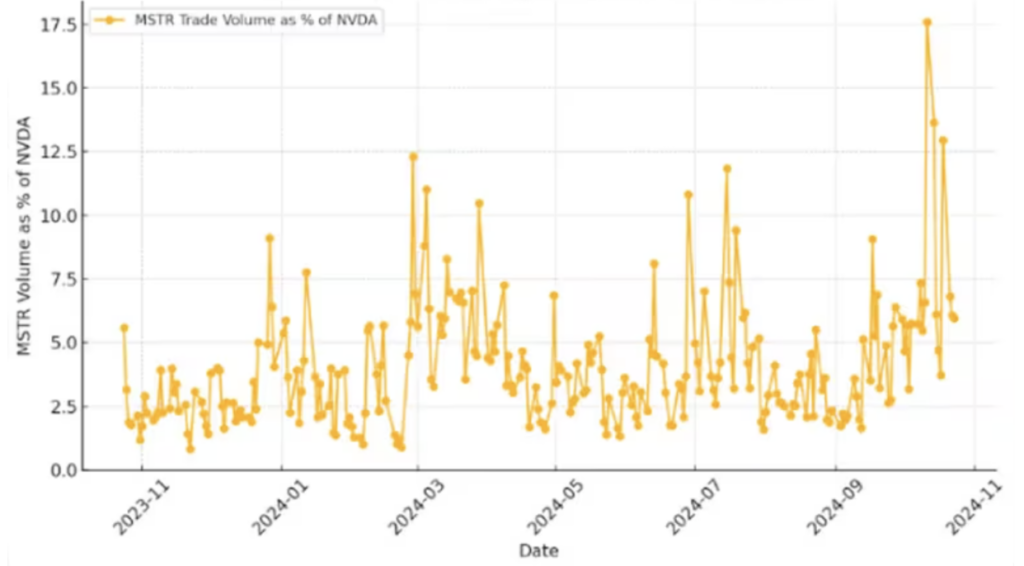

MicroStrategy’s soaring stock price is pushing its market capitalization to $43.35 billion, making it the 477th most valuable company in the world, according to Companies Market Cap data. The company is now just 8% away from a $50 billion market cap valuation. In 2024, MicroStrategy’s trading volume has seen significant growth, reaching 17.65% of Nvidia’s trading volume in October. On October 11, MicroStrategy reported a trading volume of 30 million against Nvidia’s 170 million.

Additionally, MicroStrategy’s net asset value (NAV) has continued to rise, as Bitcoin prices hover around $68,000, placing the NAV premium at almost 3—the highest level since early 2021. The combination of increasing market value, higher trading volumes, and a price rally indicates a potential continued uptrend for MicroStrategy’s stock in the months and years to come.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development