05 December 2024 Thursday

With Bitcoin failing to surpass the psychological barrier of $100,000, the balance in the crypto market shifted toward altcoins over the weekend. Ripple emerged as the market’s rising star, overtaking Tether and Solana in market capitalization.

As the crypto market closed November on a positive note, speculation has grown about the trends that will shape the final month of the year. While Bitcoin struggled to breach the $100,000 psychological threshold, popular altcoins capitalized on the moment, showing notable gains. Meanwhile, recent data indicates that spot crypto trading volume in November reached $2.71 trillion, doubling on a monthly basis and marking the highest level since May 2021.

Reflecting on these developments, Kafkas Sönmez, CEO of Gate.TR, stated, “Not only have we seen record volumes in the spot market, but Bitcoin and Ethereum futures have also recorded their highest activity since May 2021. The market is experiencing an inflow of new capital, propelled by the momentum generated after election results became clear. Although the momentum remains strong, its direction can shift. Altcoins such as Solana, Ripple, and Ethereum made headlines with significant price movements in the final days of November.”

Ripple emerged as the star performer of late November, buoyed by the announcement of SEC Chair Gary Gensler‘s departure date. The altcoin surged over 20% during the weekend, posting weekly gains of over 75% and a staggering 30-day increase of 350%. Ripple’s market capitalization climbed past Tether (USDT) and Solana (SOL), making it the third most valuable cryptocurrency globally.

Commenting on Ripple’s remarkable ascent, Sönmez highlighted, “Ripple’s native token, XRP, has distinguished itself as the altcoin most responsive to developments in the U.S. regulatory environment. The SEC’s lawsuit against Ripple remains in the appeals phase, but speculation that Gensler’s exit could lead to the charges being dropped has fueled optimism. Ripple crossed the $2 mark for the first time since 2018 and surpassed $2.50 shortly afterward. Adding to the excitement is Ripple’s potential entry into the stablecoin market with RLUSD, announced earlier this year. Ripple’s recent rally has significantly altered the altcoin landscape.”

The growing interest in altcoins can also be attributed to the resistance Bitcoin faces in surpassing $100,000 due to a substantial sell wall. Sönmez noted, “Ethereum, too, has seen notable activity, with spot Ethereum ETFs recording unprecedented inflows, pushing the cryptocurrency to its highest levels in six months. Altcoin activity has surged as investors grow more confident in their potential. Analysts estimate that Bitcoin’s path to $100,000 is blocked by $384 million worth of sell orders. Every upward movement is met with profit-taking from investors, who then channel their gains into altcoins. This rotation explains the drop in Bitcoin dominance from 61.5% on November 21 to 56.5% by the end of the month.”

Concluding his insights, Sönmez emphasized the unique challenges of bull markets: “While Gate.TR marks its second anniversary in Turkey with robust growth, we see this period as one of observation rather than active trading. Contrary to popular belief, rising markets can be as psychologically taxing for investors as declining ones. Excessive portfolio reshuffling can lead to missed opportunities or losses, even in an upward market. Investors should adopt a balanced strategy, aligning their portfolios with trusted altcoins while staying alert to market dynamics. A calm, calculated approach that incorporates profit-taking and rotation strategies is the most prudent way forward.”

As a licensed crypto asset service provider listed by Turkey’s Capital Markets Board (SPK), Gate.TR continues to empower investors with a broad range of cryptocurrencies and insightful guidance, helping them navigate the complexities of the market with confidence.

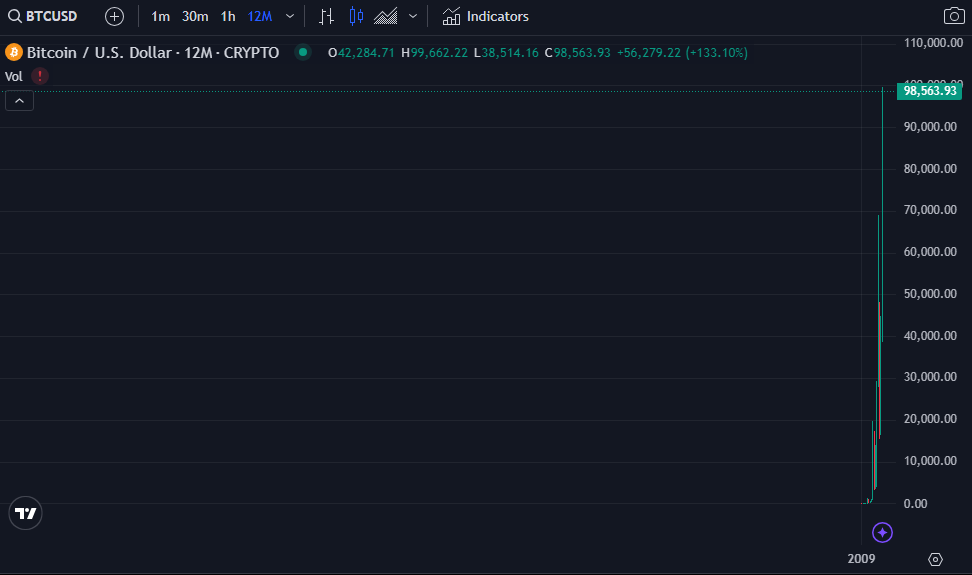

Bitcoin’s journey from a misunderstood digital experiment to a recognized financial asset has been nothing short of remarkable. As we approach 2025, the crypto world holds its breath, speculating about the future of Bitcoin price. Drawing on insights from top industry experts, market trends, and recent developments, this article delves into Bitcoin price projections, both optimistic and cautious, offering a comprehensive overview of what lies ahead.

The price of Bitcoin is more than just a number. As the leading cryptocurrency, it sets the tone for the entire market, influencing altcoins, institutional investments, and retail sentiment. Whether you’re a Bitcoin maximalist, Ethereum enthusiast, or altcoin investor, Bitcoin’s value often dictates the industry’s trajectory.

The upcoming years mark a pivotal moment for Bitcoin, as the market matures with increasing institutional involvement and regulatory clarity. Unlike past cycles driven mainly by retail speculation, Bitcoin’s price movements today are shaped by institutional investments, mainstream acceptance, and shifting geopolitical attitudes.

The approval of Bitcoin spot ETFs in the U.S. by the SEC in 2023 marked a watershed moment. With major players like BlackRock, Fidelity, and Vanguard offering Bitcoin-backed financial products, institutional interest has surged. November 2024 alone saw record inflows of $6.2 billion into these ETFs, underscoring Wall Street’s embrace of cryptocurrency.

The political landscape in the United States is evolving favorably for Bitcoin. Under the pro-crypto Trump administration, plans to make the U.S. a hub for digital assets include shifting regulatory oversight from the SEC to the CFTC and creating a Bitcoin Strategic Reserve. These developments bolster investor confidence and hint at sustained long-term growth.

The 2024 Bitcoin halving event has historically triggered price rallies, reducing the rate at which new coins enter circulation. With this scarcity mechanism in play, many experts believe the halving will catalyze Bitcoin’s next major bull run.

Several industry leaders and financial institutions offer optimistic projections for Bitcoin, supported by data and long-term market trends.

MicroStrategy’s Michael Saylor remains steadfast in his belief that Bitcoin will hit $100,000 by 2025 and continue climbing. Saylor likens Bitcoin’s volatility to the controlled chaos that fuels innovation, emphasizing its role in the asset’s growth.

Fundstrat’s Tom Lee predicts Bitcoin could soar to $250,000 in 2025, citing favorable U.S. regulations and potential government adoption of Bitcoin as a reserve asset.

Standard Chartered expects Bitcoin to reach $200,000, comparing its trajectory to gold’s post-ETF surge. The bank’s analysis points to robust inflows into Bitcoin-backed ETFs driving this price growth.

Venture capitalist Tim Draper is confident Bitcoin will reach $250,000 by 2025. He attributes this rise to its growing acceptance as a legitimate financial tool and store of value.

Not all predictions are bullish. Some experts urge caution, highlighting potential risks and market downturns.

“Rich Dad Poor Dad” author Robert Kiyosaki predicts a temporary crash to $60,000 before Bitcoin rebounds to $250,000 by the end of 2025. His outlook is shaped by anticipated market corrections and external economic pressures.

InvestingHaven suggests a bearish scenario where Bitcoin could drop to $75,000 if institutional momentum slows or unexpected regulatory barriers emerge.

Unlike previous cycles, which relied heavily on speculative retail interest, the current bull market benefits from foundational shifts:

Tim Draper and Tom Lee predict Bitcoin could reach $250,000 in 2025, driven by institutional adoption and favorable regulations.

Standard Chartered and Alliance Bernstein believe Bitcoin could exceed $200,000, fueled by ETF inflows and the 2024 halving event.

Bitcoin’s volatility stems from its limited supply, speculative trading, and evolving regulatory environment, which can lead to sharp price fluctuations.

The halving is expected to reduce Bitcoin’s supply growth, potentially driving demand and pushing prices higher, as seen in past cycles.

While many experts are optimistic, potential investors should consider market volatility, regulatory risks, and long-term adoption trends before investing.

Some bearish predictions suggest short-term drops, but most analysts agree Bitcoin’s long-term trajectory remains upward.

As 2025 approaches, Bitcoin’s price projection is a hot topic among experts and investors. With bullish predictions ranging from $100,000 to $250,000, the outlook reflects optimism rooted in institutional adoption, regulatory shifts, and historical market cycles. However, risks remain, from regulatory hurdles to unexpected market downturns.

Investors must navigate this dynamic landscape with a mix of caution and confidence. Bitcoin’s inherent volatility continues to make it both a high-risk and high-reward investment. Whether Bitcoin soars past $200,000 or faces temporary setbacks, its role as a transformative financial asset is indisputable.

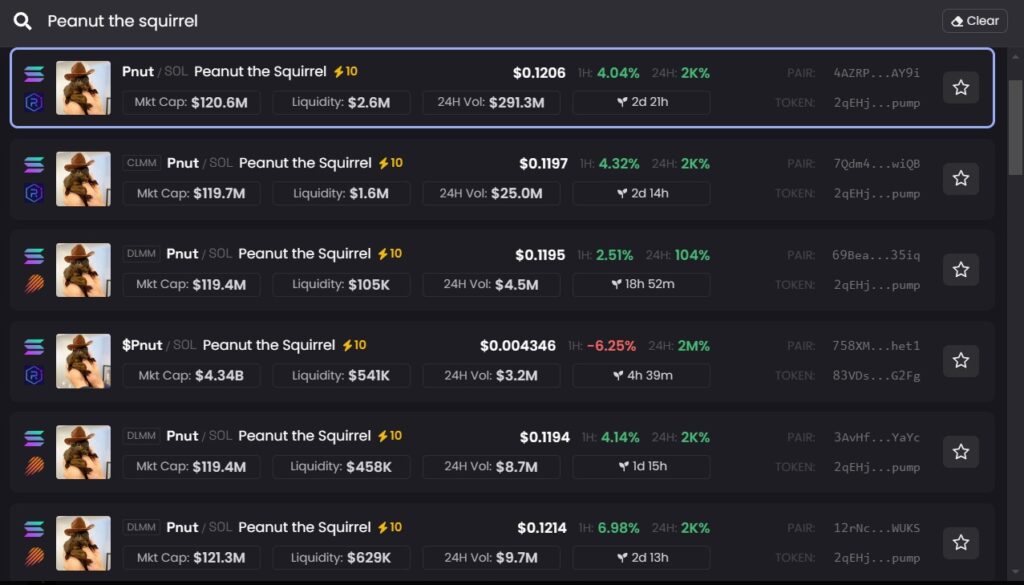

In a whirlwind of events, memecoins inspired by “Peanut the Squirrel” have made an explosive entry into Solana’s decentralized finance (DeFi) ecosystem, with some tokens reaching market capitalizations of over $120 million.

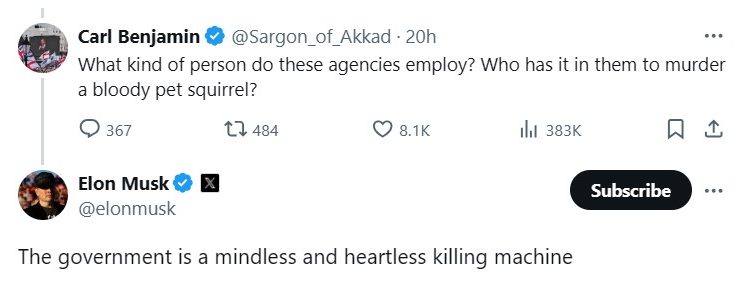

The sudden surge in Peanut-themed tokens follows a controversial incident involving Peanut, a popular squirrel with over 600,000 social media followers managed by Mark Longo. On October 30, New York’s Department of Environmental Conservation reportedly seized and euthanized Peanut along with a raccoon named Fred after complaints alleging inadequate housing. Heartbroken by the loss, Longo took to Instagram to express his frustration:

“Well internet, you WON. You took one of the most amazing animals away from me because of your selfishness. To the group of people who called DEC, there’s a special place in hell for you.”

Longo first rescued Peanut around seven years ago after witnessing the animal’s mother struck by a car. Due to injuries that would make survival in the wild unlikely, Longo nursed Peanut back to health and raised him as a companion. This recent event has sparked outrage online, with high-profile figures like Elon Musk condemning the decision, calling it “mindless” and “heartless.”

Peanut’s tragic story and growing fame have spurred the creation of a series of memecoins themed around the beloved squirrel. According to decentralized exchange tracker Dexscreener, multiple Peanut-inspired tokens have been launched on the Solana network, and two of these tokens have even climbed into the top 10 in Dexscreener’s 24-hour charts.

One token, simply named “Peanut the Squirrel” (PNUT), has seen staggering activity. Within two days, it recorded nearly $300 million in trading volume across more than 200,000 transactions. After reaching a peak market capitalization of $120 million, the token has since settled at around $100 million following a brief correction.

Another Peanut-themed memecoin launched on the BNB Smart Chain has also attracted significant attention, reaching a market cap of $80 million with trading volumes exceeding $110 million.

Meanwhile, a Fred-themed token, “First Convicted Raccoon” (FRED), was launched in homage to the raccoon euthanized alongside Peanut. Although it recorded an impressive 150,000 transactions and an $83 million trading volume, the project currently has a more modest market capitalization of $8.2 million.

This latest trend demonstrates the power of internet culture in shaping DeFi markets. Peanut’s story, coupled with the outrage surrounding his passing, has sparked a unique movement, drawing both sympathy and speculative investment from the crypto community.

PNUT – In a matter of days, the Solana-based meme coin Peanut the Squirrel (PNUT) has skyrocketed from relative obscurity to $150 million in trading volume, fueled by a potent mix of public outrage and pre-election fervor.

The story gained significant traction when Mark Longo, Peanut’s caretaker, announced on social media that New York’s Department of Environmental Conservation (DEC) had taken Peanut and another pet, a raccoon named Fred, citing rabies concerns. The tragic narrative surrounding Peanut—a beloved pet squirrel seized and ultimately euthanized by New York state authorities—exemplifies the unpredictable impact that social media can have on the crypto market.

Peanut had become an internet sensation with over 500,000 followers, cherished not only as a pet but also as a family member and a staple in Longo’s online community. As the news spread, backlash against the DEC intensified, especially after Elon Musk, CEO of Tesla and SpaceX, weighed in on the situation. Musk, a prominent supporter of presidential candidate Donald Trump, criticized the DEC’s actions, tweeting, “The government should not be allowed to barge into your house and kill your pet! That’s messed up.”

Musk’s pinned tweet on the matter also referenced PNUT, aiming to draw more attention to Peanut’s story. This endorsement sparked increased interest, pushing PNUT’s price to a peak of $0.14 before early investors began cashing in on their profits. Musk has a history of tweeting memes related to the crypto industry, including his affection for Dogecoin, which likely contributed to the frenzy surrounding Peanut.

As the U.S. presidential election on November 5 approaches, others have quickly politicized Peanut’s story. At a rally in Sanford, North Carolina, Senator JD Vance, who is Trump’s running mate, remarked that Trump was “fired up” about the situation, framing Peanut’s death as a glaring example of government overreach. Vance and other conservative figures, including New York Congressman Nick Langworthy, contended that authorities should focus on more pressing issues instead of targeting animals, using Peanut’s plight as a campaign talking point.

Despite the initial excitement, the frenzy surrounding PNUT appears to be cooling down. According to Gecko Terminal data, the market cap of PNUT has since fallen to $49 million, with the price dropping to $0.04 as early investors began to take profits, stabilizing the token after its explosive ascent.

In a heartfelt social media post, Longo expressed his grief over Peanut’s loss and his determination to continue the squirrel’s legacy, stating, “I will set up a fundraiser for those who want to donate in Peanut’s name. I’ll never give up on this nonprofit or those who fell in love with Peanut.”

Over the past month, Sui (SUI) has experienced significant price volatility, sparking a surge in negative sentiment around the asset. On October 14, SUI reached an all-time high (ATH) of $2.36, fueled by a strong bullish trend in the broader cryptocurrency market. Contributing to this positive momentum was the launch of MLS Quest, a Major League Soccer-themed non-fungible token (NFT) platform, developed in collaboration with the gamified blockchain startup, Sweet. Another major development supporting SUI’s rally was the launch of USD Coin on Sui’s mainnet, which added to investor enthusiasm.

However, SUI’s upward momentum was short-lived. Within two weeks of its ATH, the asset began to lose steam as the overall crypto market underwent a correction.

Santiment data shows a significant drop in the weighted sentiment around SUI on social platforms, shifting from a positive 0.06 to a negative -0.06 over the past two days. This change suggests rising fear, uncertainty, and doubt (often referred to as FUD), which can lead to downward pressure on an asset’s price.

Additionally, market intelligence data indicates that the total open interest in SUI’s perpetual contracts fell sharply—from $895 million on October 7, during the peak of the market rally, to $330 million at present. This marks a two-month low for SUI’s open interest.

Despite the increasingly negative sentiment, there has been a slight recovery in SUI’s funding rate, which moved from -0.002% to 0.01% as its price briefly rose above $1.95 earlier today.

As of the latest data, SUI has gained 0.3% in the past 24 hours and is currently trading at $1.88. With a market cap of $5.3 billion, SUI remains the 18th-largest cryptocurrency by market capitalization. The asset’s daily trading volume has surged by 30%, reaching $630 million.

However, SUI faces the risk of further correction. If this occurs, it could lead to substantial long liquidations, potentially causing investor panic and a broader selloff due to the prevailing negative sentiment surrounding the asset.