04 November 2024 Monday

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

Relative Strength Index (RSI): A Comprehensive Guide to Understanding and Using This Indicator

Wall Street Awaits AI Payoff as Tech Giants' Capex Soars Ahead of Fall Earnings

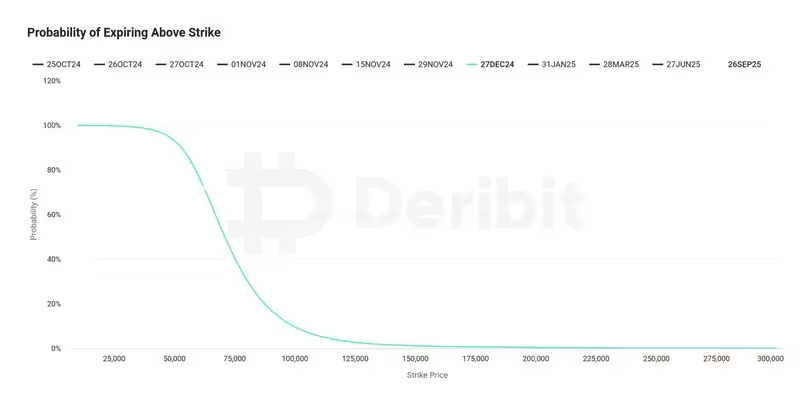

Bitcoin Price Predictions– At the time of writing, options pricing on the leading exchange Deribit indicates a 9.58% probability that Bitcoin (BTC) will surpass the $100,000 mark by the end of December, as reported by Deribit Metrics. This figure provides insight into market sentiment and potential price movements as the year draws to a close.

Options are derivative contracts that grant the buyer the right, but not the obligation, to purchase or sell an underlying asset at a predetermined price before a specific date. A call option allows for the purchase of the asset, reflecting a bullish outlook, while a put option offers protection against declining prices. Despite the near 10% probability seeming low to bullish investors—especially given the market’s recovery from supply concerns in the second and third quarters—this aligns with the relatively stable implied volatility of Bitcoin. The Deribit Volatility Index (DVOL) remains between 50% and 60%, significantly lower than the 85% peak observed in March 2024.

Options-implied probabilities are derived using models such as the Black-Scholes model, which incorporates current market prices, strike prices, time until expiration, volatility, and risk-free rates. The relationship is clear: higher volatility typically results in increased probabilities of Bitcoin reaching specific price levels.

Several traders have indicated that Bitcoin could realistically reach around $80,000 by the end of the year, regardless of the outcome of the crucial U.S. presidential election set for November 5. The options market suggests a potential 22% price fluctuation in either direction by year-end, indicating a feasible rally above $80,000.

Griffin Ardern, head of options trading and research at the crypto financial platform BloFin, noted, “The current market implied volatility of BTC at-the-money options expiring on December 27 is 54%, which means that in the best-case scenario, BTC could rise more than 22% to approximately $82,000 by year-end.” However, Ardern cautioned that volatility can work both ways, so a significant price drop cannot be ruled out.

It’s essential to recognize that options market probabilities can fluctuate rapidly due to changing market conditions. The likelihood of Bitcoin reaching $100,000 by the year-end could increase if implied volatility rises and prices set new highs.

The upcoming U.S. presidential election may significantly impact regulatory perspectives in the digital assets industry and could inject volatility into the market. Currently, pro-crypto Republican candidate Donald Trump leads over his Democratic counterpart, Kamala Harris, in election polls. The results will be announced on November 8.

Alexander Blume, CEO of the SEC-registered digital assets advisory firm Two Prime, commented, A Harris or Trump victory is not fully priced in, and crypto investors should brace for considerable volatility in either scenario. This situation is reminiscent of biotech stocks on the days the FDA announces drug approvals—these stocks either soar or crash, and volatility is expected.

Blume further stated that a win for Harris could negatively impact the market, at least temporarily, as traders betting on a Trump victory might close their leveraged positions, leading to bearish volatility in Bitcoin prices.

In summary, the options market presents a nuanced view of Bitcoin’s potential trajectory as 2023 comes to a close. With varying probabilities and external factors like the U.S. election on the horizon, investors should remain vigilant and adaptable in their strategies.

The 9.58% probability indicates that market participants estimate there’s a roughly 1 in 10 chance Bitcoin will surpass the $100,000 mark by the end of December. This figure is derived from options pricing and reflects current market sentiment and conditions.

Implied volatility measures market expectations for price fluctuations. Higher implied volatility generally indicates that traders expect larger price swings, which can lead to higher probabilities for Bitcoin hitting certain price levels. Conversely, lower volatility suggests more stable price movements, potentially reducing the likelihood of significant price changes.