04 November 2024 Monday

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

Relative Strength Index (RSI): A Comprehensive Guide to Understanding and Using This Indicator

Wall Street Awaits AI Payoff as Tech Giants' Capex Soars Ahead of Fall Earnings

Crypto Market – The number of crypto investors in South Korea has surged to 7.78 million in the first half of 2024, reflecting a 21% increase from the 6.45 million investors recorded in the second half of 2023. This growth signals a robust interest in digital assets, coinciding with the increasing profitability of the country’s digital asset exchanges.

According to data from South Korea’s Financial Services Commission, the cumulative operating profits of the top 21 local centralized exchanges (CEXs) have soared to over 5,900 billion won, or approximately $4.2 billion. This marks a staggering 106% year-on-year (YoY) increase, underscoring the growing market dynamics and the influx of retail investors.

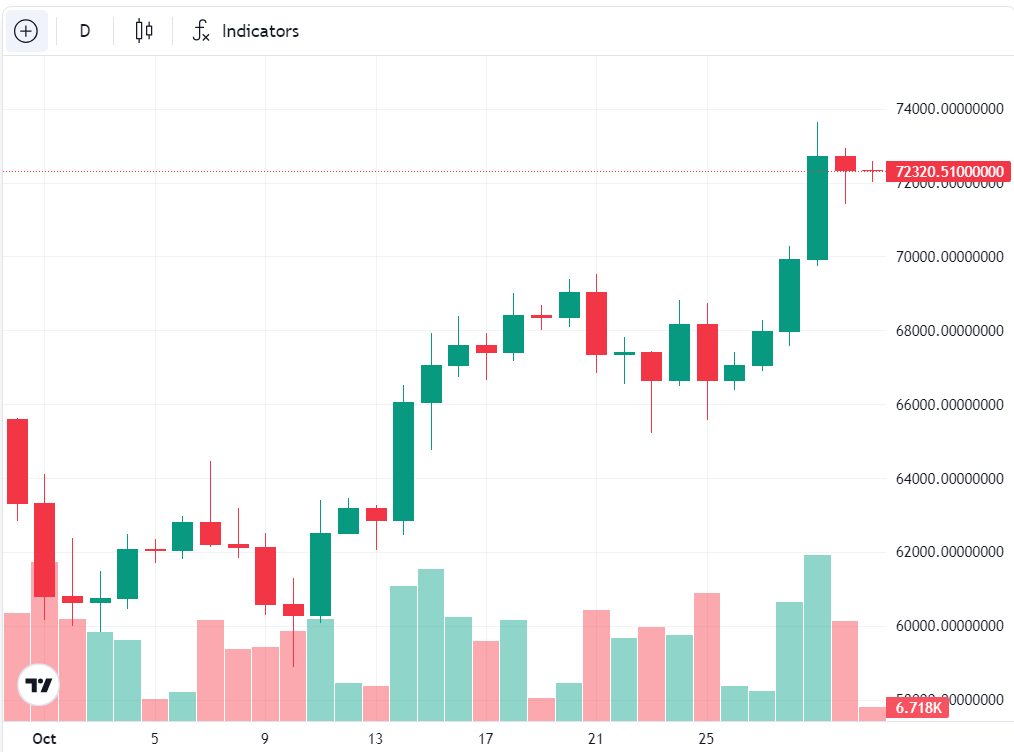

The rise in retail investors is seen as a positive indicator for a potential bull market, as this new capital influx is likely to contribute to further price appreciation of leading cryptocurrencies like Bitcoin (BTC) and Ether (ETH). Bitcoin has recently approached its all-time high, trading just $200 away from a record price after surpassing $73,600—the highest level since March 2024.

Despite the optimistic market sentiment, some analysts have expressed caution. They suggest that Bitcoin’s current price movements may be a “Trump hedge,” lacking the fundamental macroeconomic conditions necessary to propel the cryptocurrency to new heights.

Interestingly, the average crypto portfolio for South Korean investors remains modest, with the average allocation below $400. More than 68% of the investors are male, predominantly aged over 30, accounting for 5.28 million individuals. Notably, there are only 850,000 male investors above the age of 50.

A significant portion of investors—67%—hold less than $362 worth of crypto in their portfolios. Conversely, only 10%, or approximately 780,000 investors, own more than $7,254 in digital assets.

When examining the largest holdings among South Korean investors, the breakdown reveals that over 37% of their portfolios are allocated to Bitcoin, while 11% is invested in Ether. Other notable allocations include 10.6% in XRP, 2.8% in Dogecoin (DOGE), and 2.7% in Ethereum Classic (ETC).