04 November 2024 Monday

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

Relative Strength Index (RSI): A Comprehensive Guide to Understanding and Using This Indicator

Wall Street Awaits AI Payoff as Tech Giants' Capex Soars Ahead of Fall Earnings

Michael Saylor’s recent comments regarding Bitcoin custody have ignited significant debate within the cryptocurrency community. On October 21, Saylor, the executive chairman of MicroStrategy, suggested that Bitcoin holders should trust too big to fail banks rather than pursuing self-custody. This statement drew immediate backlash from notable figures in the crypto space, including Ethereum co-founder Vitalik Buterin, who labeled Saylor’s remarks as batshit insane.

Following the uproar, Saylor quickly amended his stance, reaffirming his support for self-custody rights. This was particularly relevant as MicroStrategy announced it held a substantial 252,220 BTC, valued at around $18.2 billion. The incident highlights a growing ideological divide within the Bitcoin community between those advocating for complete decentralization and those welcoming institutional involvement in the crypto sector.

Nate Holiday, CEO of Space and Time, remarked that Saylor’s comments reflect fundamentally different objectives in the crypto landscape. MicroStrategy aims to create wealth for its shareholders, and they benefit when Bitcoin’s price rises, Holiday explained. In contrast, many in the Web3 space are focused on decentralizing technology to build a verifiable world that minimizes reliance on intermediaries.

The discourse surrounding custody methods raises essential questions about the future of Bitcoin. Peko Wan, co-CEO of Pundi X, emphasized that institutional custody could shift the community’s perspective toward reliance on third-party trust, undermining the self-sovereignty principle central to Bitcoin’s ethos. Ryan Chow, CEO of Solv, echoed this sentiment, stating that true ownership is only achieved when investors have control over their coins.

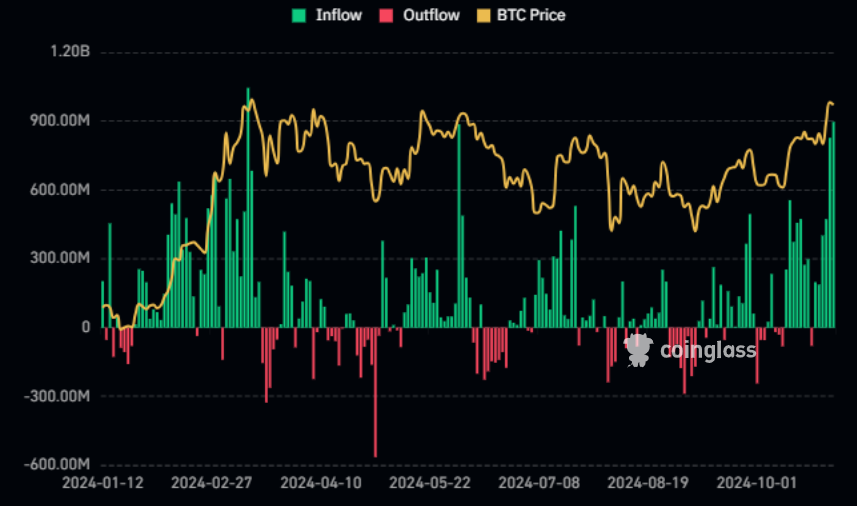

As institutional interest in Bitcoin surges, the dynamics are shifting. On October 30, spot Bitcoin ETFs recorded over $800 million in daily inflows, the highest since June. Ben Caselin, chief market officer at VALR, noted that Bitcoin’s performance in various interest environments has attracted institutional investors, contributing to these record inflows. Moreover, hedge fund participation in digital assets has risen significantly, with 47% of traditional hedge funds now exposed to digital assets, up from 29% in 2023, according to KuCoin’s Alicia Kao.

Saylor’s controversial remarks might signal a potential bifurcation in Bitcoin’s future, where both institutional and self-sovereign ecosystems coexist. Wan suggested that large holders might favor institutional custody, while individuals valuing self-sovereignty could lean toward self-custody solutions. Ian Lee, head of operations at Flipster, added that while institutional custody raises concerns about decentralization, it is not a direct threat, as self-custody remains an option.

As the cryptocurrency industry evolves, the tension between institutional adoption and decentralization will likely continue. Holiday cautioned that viewing Bitcoin solely as a financial asset could invite co-option by mainstream finance. However, as a decentralized protocol, Bitcoin remains secure. Chow emphasized that Bitcoin’s permissionless nature allows for both approaches to coexist, allowing individuals to choose the custody method that suits them best.

The challenge moving forward will be to maintain the option for self-custody while embracing institutional involvement, ensuring Bitcoin adheres to its original vision amidst growing mainstream acceptance. Ultimately, Saylor’s reversal serves as a reminder that Bitcoin’s future hinges on balancing its revolutionary roots with its emerging role in the global financial landscape.

The debate was ignited by Michael Saylor’s comments suggesting that Bitcoin holders should trust their assets to large banks, which he referred to as “too big to fail,” while dismissing self-custody advocates. This led to strong backlash from notable figures in the crypto space, emphasizing the ideological divide between those favoring decentralization and those embracing institutional involvement.

Institutional custody solutions could shift the community’s mindset towards relying on third-party trust, potentially undermining Bitcoin’s self-sovereign philosophy. However, experts suggest that institutional custody should be seen as an additional option rather than a replacement for decentralization, as individuals still have the choice to self-custody their assets.