04 November 2024 Monday

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

Relative Strength Index (RSI): A Comprehensive Guide to Understanding and Using This Indicator

Wall Street Awaits AI Payoff as Tech Giants' Capex Soars Ahead of Fall Earnings

Solana vs Ethereum– Despite receiving some inflows from various blockchains, Solana has faced challenges in retaining total value locked (TVL), particularly as significant amounts flow back to Ethereum. Michael Nadeau, founder of The DeFi Report, emphasizes this trend in his recent analysis.

In a post on X, Nadeau pointed out that Solana must focus on pulling TVL away from Ethereum and layer-2 networks to solidify its position in the market. He stated, […] But the only thing that really matters for Solana is pulling TVL from Ethereum (and the L2s). Why? That’s where all the value sits today. Is it happening? Not really.

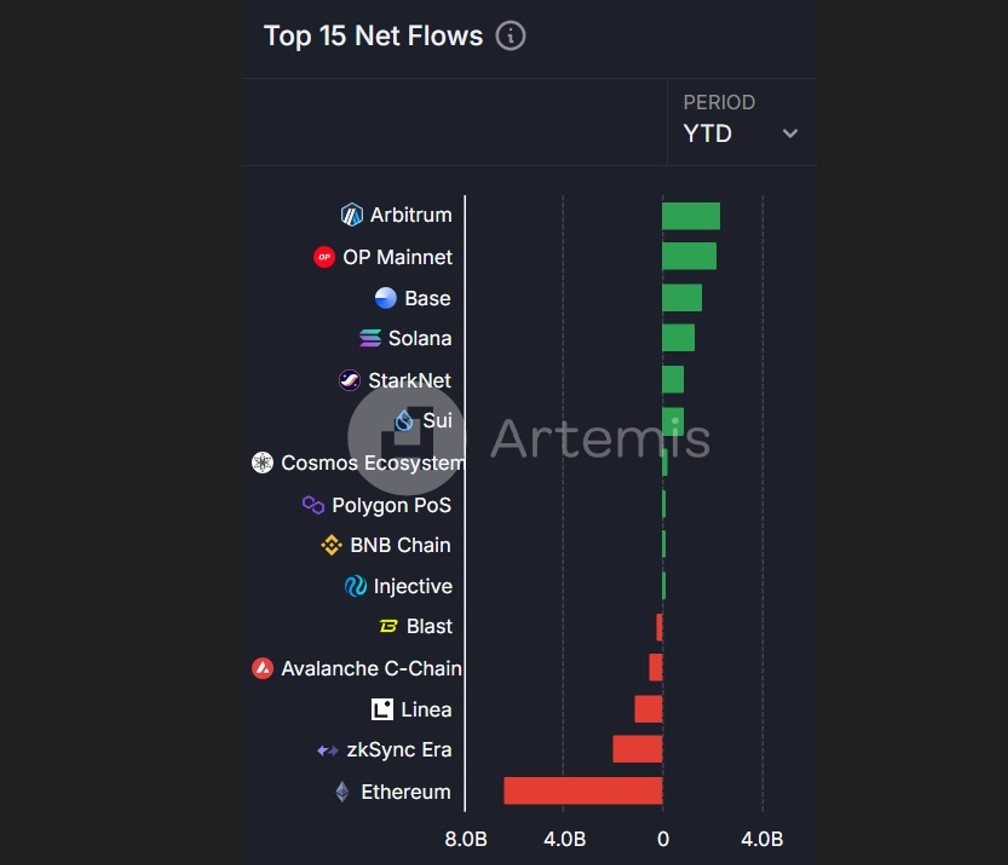

According to data from crypto analytics platform Artemis, Solana has experienced a year-to-date loss of approximately $55 million in TVL to competing networks like Base, Optimism, and Arbitrum. Even though Solana has attracted about $2.36 billion in inflows from Ethereum during the same period, over $1 billion has returned to Ethereum, which represents 42% of Solana’s total inflows.

Nadeau noted that the flow of assets into Solana from Ethereum has been relatively modest, accounting for only 2.7% of Solana’s TVL. As of now, Ethereum boasts more than $50 billion in total value locked, according to data provider DefiLlama. Nadeau also mentioned that Ethereum has experienced $6 billion in net outflows year-to-date, with 83% of these assets moving to layer-2 solutions within its ecosystem.

He explained that these assets are likely to continue driving value to layer-1 Ethereum, as much of the capital that has left is still being utilized within Ethereum’s broader ecosystem.

In a surprising development, Solana surpassed Ethereum in daily transaction fees on October 28, generating over $2.54 million in fees within a 24-hour period. This marked a significant achievement, especially since it exceeded Ethereum’s $2.07 million in fees for the same timeframe. As a result, Solana became the fifth-largest fee-generating protocol on that day.

This surge in fees has been linked to increased activity on Raydium, a decentralized exchange (DEX) and automated market maker built on the Solana blockchain. The heightened transaction volume indicates a robust level of engagement within Solana’s ecosystem, even as challenges persist in retaining long-term value.

Solana is facing challenges in retaining TVL primarily because a significant portion of its inflows is flowing back to Ethereum. According to Michael Nadeau, founder of The DeFi Report, most of the crypto value remains anchored in Ethereum and its layer-2 solutions. Solana needs to attract more value from Ethereum to enhance its DeFi ecosystem.

On October 28, Solana surpassed Ethereum in daily transaction fees, generating over $2.54 million compared to Ethereum’s $2.07 million. This achievement positioned Solana as the fifth-largest fee-generating protocol for that day, largely due to increased activity on Raydium, a decentralized exchange built on the Solana blockchain.