05 December 2024 Thursday

Over the past month, Sui (SUI) has experienced significant price volatility, sparking a surge in negative sentiment around the asset. On October 14, SUI reached an all-time high (ATH) of $2.36, fueled by a strong bullish trend in the broader cryptocurrency market. Contributing to this positive momentum was the launch of MLS Quest, a Major League Soccer-themed non-fungible token (NFT) platform, developed in collaboration with the gamified blockchain startup, Sweet. Another major development supporting SUI’s rally was the launch of USD Coin on Sui’s mainnet, which added to investor enthusiasm.

However, SUI’s upward momentum was short-lived. Within two weeks of its ATH, the asset began to lose steam as the overall crypto market underwent a correction.

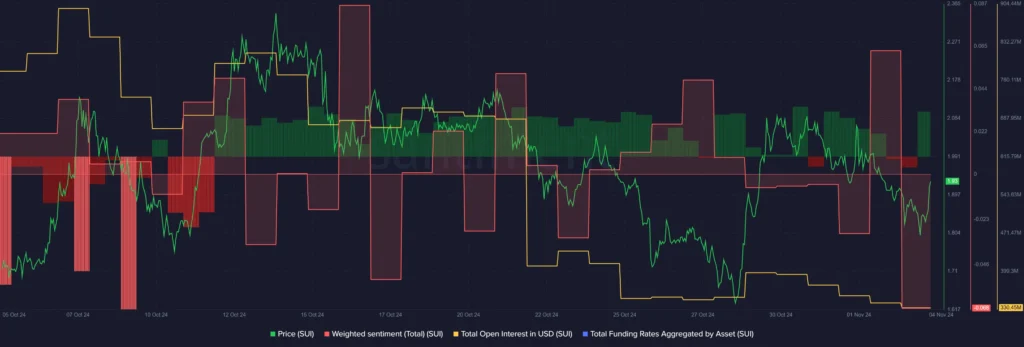

Santiment data shows a significant drop in the weighted sentiment around SUI on social platforms, shifting from a positive 0.06 to a negative -0.06 over the past two days. This change suggests rising fear, uncertainty, and doubt (often referred to as FUD), which can lead to downward pressure on an asset’s price.

Additionally, market intelligence data indicates that the total open interest in SUI’s perpetual contracts fell sharply—from $895 million on October 7, during the peak of the market rally, to $330 million at present. This marks a two-month low for SUI’s open interest.

Despite the increasingly negative sentiment, there has been a slight recovery in SUI’s funding rate, which moved from -0.002% to 0.01% as its price briefly rose above $1.95 earlier today.

As of the latest data, SUI has gained 0.3% in the past 24 hours and is currently trading at $1.88. With a market cap of $5.3 billion, SUI remains the 18th-largest cryptocurrency by market capitalization. The asset’s daily trading volume has surged by 30%, reaching $630 million.

However, SUI faces the risk of further correction. If this occurs, it could lead to substantial long liquidations, potentially causing investor panic and a broader selloff due to the prevailing negative sentiment surrounding the asset.