04 November 2024 Monday

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

Relative Strength Index (RSI): A Comprehensive Guide to Understanding and Using This Indicator

Wall Street Awaits AI Payoff as Tech Giants' Capex Soars Ahead of Fall Earnings

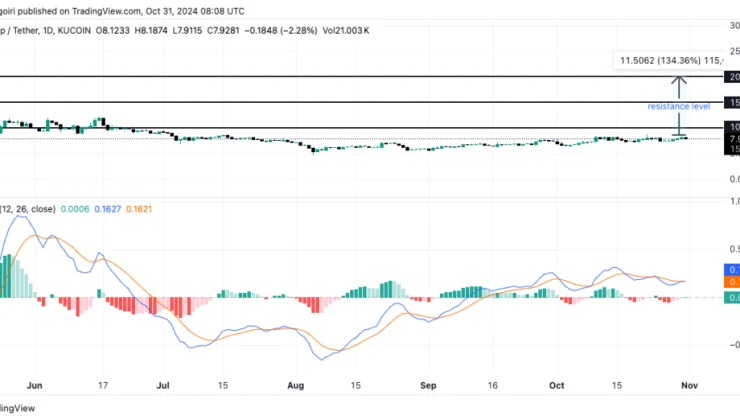

The price of Uniswap (UNI) has seen a robust rally, signaling a bullish trend as it trades above a critical support level. This upward momentum reflects renewed investor confidence, aligning with a broader recovery across the cryptocurrency market as November nears. With sustained momentum, UNI could be on a path to target the $20 mark in the upcoming weeks.

Currently trading at $8.23, UNI has climbed by 4.42% over the last 24 hours, maintaining a bullish trajectory. In the past 24 hours, UNI has traded between $7.83 and $8.26, showcasing heightened investor interest. However, despite this recent growth, UNI remains well below its all-time high of $44.97 from May 2021—a substantial 81.68% decline from peak levels.

The analysis highlights resistance zones at $10, followed by $15 and $20. Overcoming these barriers could trigger a significant rally, potentially reaching the $20 mark and marking a 134% surge if bullish trends persist.

Supporting these insights, the Moving Average Convergence Divergence (MACD) indicator shows modest bullish momentum, with the MACD line hovering above the signal line and green bars on the histogram, reinforcing positive sentiment.

Furthermore, data from Coinglass reveals a substantial increase in UNI derivatives trading volume and open interest, indicating rising interest and engagement from the market.

With strong bullish signals and growing market attention, UNI may be primed for further gains. Should it successfully break through resistance levels, Uniswap could potentially rally towards the $20 target, driven by sustained trading volume and market momentum.