05 December 2024 Thursday

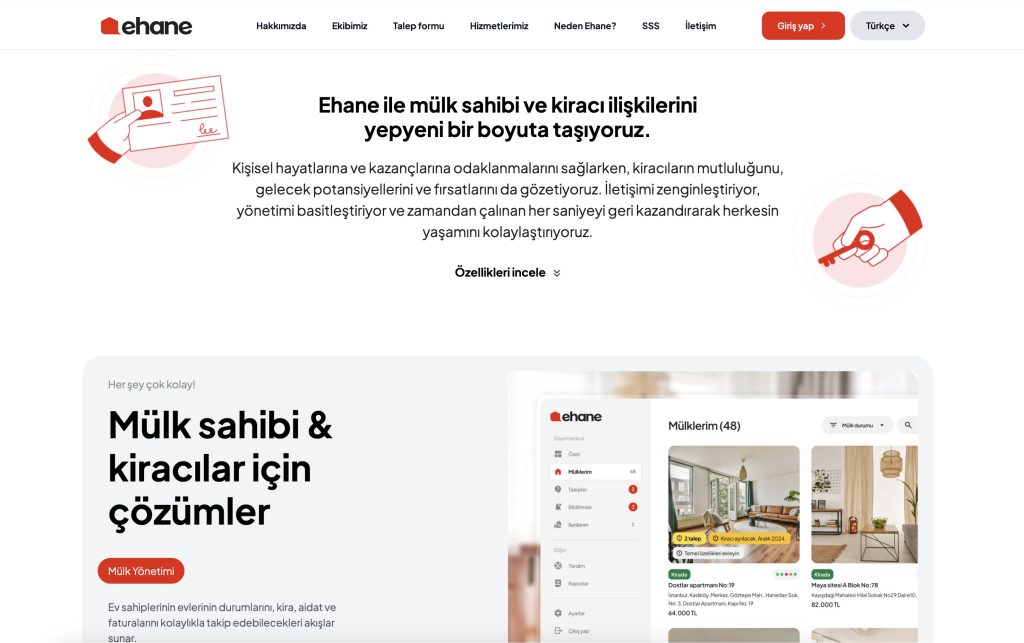

Ehane.com, a groundbreaking property management platform, has officially launched to redefine the relationship between property owners and tenants in Turkey.

Developed by Manivela Ventures over a period of 10 months, leverages technology to solve the growing challenges of property ownership. From finding the ideal tenant to offering end-to-end support throughout the rental process, Ehane.com addresses every need of property owners. It also provides access to a smart assistant through its dedicated call center.

By alleviating the administrative burdens of property management, Ehane.com not only saves time for property owners but also ensures the consistent and timely collection of rental income. Its comprehensive services cover legal assistance, utility and fee tracking, document management, property condition assessments, tenant sourcing, and even the eviction process when necessary.

Ehane.com doesn’t overlook the needs of tenants either. The platform offers a wide array of services, from legal assistance and moving support to maintenance services and compliance with legal obligations. It also helps tenants find their ideal homes, determines fair rental values, and provides continuous assistant support via its call center.

With a mission to bring Istanbul’s 750,000 vacant homes into the economy through professional property management, Ehane.com offers tailored services for foreign property owners in Turkey.

Supported by a team of experts in technology and real estate, website provides services in both Turkish and English, ensuring that foreign property owners can manage their investments seamlessly. The platform also assists expats seeking rental homes in Turkey, guiding them to secure the perfect property.

Initially focusing on Istanbul, website has started welcoming its first clients and plans to expand its services to other major cities across Turkey by early 2025 under the Manivela Ventures umbrella.

Users can unlock time-saving solutions by simply filling out the inquiry form on ehane.com.

A new player has entered the ranks of Turkey’s private equity firms. In the first quarter of 2024, three renowned senior executives from the Turkish business world joined forces to establish DSG Investments, a private equity firm focused on technology, mergers and acquisitions, business development, and investments.

With expectations that global monetary tightening would ease in the second half of 2024, the private equity market experienced a resurgence. Seizing on the shifting dynamics in Turkey’s private equity sector, three prominent executives founded DSG Investments to provide investment and advisory services to high-potential local companies.

DSG Investments was co-founded by Oktay Demir, who served in various high-level roles including General Counsel, Board Member, and CEO of D-Smart at Doğan TV Holding; Cem Soysal, who previously held CEO positions at Vestel, Doğan Online, Fujitsu Siemens, and the venture capital fund Inventram; and Ali Güven, whose extensive career includes CEO roles at IBM, Logo Software, D-Smart, and Value Partners Italy across Turkey, France, and the UAE.

DSG Investments Co-Founder Cem Soysal described the firm’s mission:

“DSG was established as an investment and advisory firm focused on facilitating mergers and acquisitions, restructuring businesses, and ultimately evolving into a technology fund.”

Specializing in mergers and acquisitions (M&A), management consulting, regulation, technology, and media, DSG Investments leveraged its expertise in capital management to complete its first investment in July. The firm invested in Autodrom, Turkey’s first and only Ministry of Education-certified advanced driving techniques training complex, established in Istanbul in 2003. DSG Investments successfully modernized Autodrom to meet contemporary standards during a restructuring process, culminating in a successful sale.

Cem Soysal emphasized DSG Investments’ mission of stabilizing and enhancing the profitability of high-potential businesses.

“DSG is committed to driving efficient growth, preparing companies for investment opportunities, and achieving sustainable profitability. In an era of diversified risks, companies like DSG become strategic partners that add value for all stakeholders,” Soysal remarked.

With its experienced team and a strong focus on strategic investments and results-driven portfolio management, DSG Investments is positioning itself as a leader in the sector.

“We are dedicated to enhancing the performance, strengthening the potential, and fostering a culture of growth within the companies we partner with,” said Soysal. “Our first test, the investment and restructuring of Autodrom in 2024, was a resounding success. Starting with three technology-focused partners, DSG Investments is steadfast in its mission to become a leading technology fund, assembling a portfolio of integrated technology companies operating to world-class standards.”

Crypto Market Rally– Recent data from Cointelegraph Markets Pro and TradingView indicates a notable rebound in Bitcoin (BTC) prices after the release of October’s nonfarm payrolls. The figures revealed a significant shortfall in job additions, with only 12,000 jobs created compared to the anticipated 106,000. Moreover, revisions for previous months were substantial, with September and August’s job numbers lowered by 31,000 and 81,000, respectively.

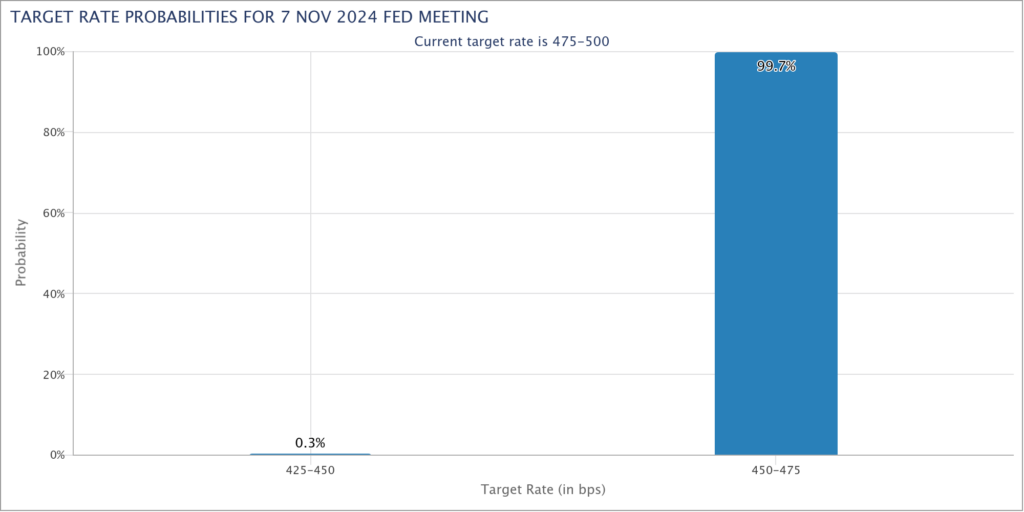

The unemployment rate remained stable at 4.1%, meeting expectations. The Kobeissi Letter commented on the data, stating, This marks the lowest number of US jobs added since July 2021. All signs continue to point toward a weaker labor market. Analysts from Kobeissi further anticipate that the Federal Reserve will cut interest rates by 0.25% in their upcoming meeting on November 7, a sentiment echoed by CME Group’s FedWatch Tool. Following the release of this data, the US Dollar Index (DXY) fell to 103.6 before making a slight recovery.

Crypto trader and analyst Michaël van de Poppe shared his insights on X, highlighting the negative impact of the nonfarm payroll results, which represent the worst performance since January 2021. Van de Poppe noted that easing economic conditions could signal a market reversal, stating, The reversal is around the corner as labor markets are getting softer. At the time of reporting, BTC/USD saw a 1.6% increase, surpassing $71,000 and triggering short liquidations.

Fellow trader Titan of Crypto identified $71,300 as a crucial support level to maintain momentum. He remarked, October’s candle close erased four months of downward price action in one go. Extremely bullish. The cloud also shows bullish signs, referring to his Ichimoku cloud analysis of the one-month chart.

The October jobs report showed that the U.S. economy added only 12,000 jobs, significantly below the expected 106,000. This disappointing data led to a rebound in Bitcoin’s price, pushing it above $71,000 as traders reacted to the potential for lower interest rates.

Analysts, including Michaël van de Poppe, predict a bullish reversal for Bitcoin as labor markets show signs of softening. With expectations of a potential interest rate cut by the Federal Reserve, Bitcoin’s price is positioned to benefit from looser economic conditions.

One analyst cautions that a close contest between the presidential contenders could potentially cause some surprise volatility, even if many cryptocurrency traders are attempting to predict the market’s direction based on the results of the next US election. After the cryptocurrency market has been directionless since April, traders will be happy when the US election concludes because it will clear the path for the markets, according to David Lawant, head of research at FalconX.

Additional volatility, however, could emerge if results are too close to call and it takes too much time to reach an outcome. After six months of directionless trading, markets appear eager to move past election uncertainty toward firmer ground,

Lawant

Although investors are hoping for positive outcomes regardless of the party that wins the US election on November 5, Lawant stressed that some think a Donald Trump victory could result in larger benefits because of his more definite pro-industry pledges. Pav Hundal, the lead analyst of Swyftx, recently stated that a Trump win would probably result in a dopamine surge. Regardless of the result, options traders seem certain that Bitcoin will surpass its previous peak within weeks of the election. According to Lawant, Solana also sticks out in discussions as a possible outperformer, in addition to Bitcoin.

BTC, serving as crypto’s proxy, could further benefit from ETF flows—2024’s primary source of new capital. SOL’s strong narrative positions it as a likely destination for profit diversification.

Lawant

For more up-to-date crypto news, you can follow Crypto Data Space.

Crypto Market News – The crypto market has historically shown a strong connection to political events, particularly US elections. As we approach the 2024 election cycle, many investors are looking for signals from the crypto market that could indicate potential outcomes. Notably, those who invested $1,000 in Bitcoin on US Election Day in 2016 witnessed their investment grow to over $10,000 within a year.

While it’s challenging to predict how upcoming policies will shape the crypto landscape, certain trends appear to repeat themselves post-election. Major cryptocurrencies, particularly Bitcoin and Ethereum, have historically experienced significant price increases after elections.

For instance, during the 2016-2017 period, Bitcoin’s price skyrocketed from around $703 to $7,141. Similarly, an investment of $1,000 in Ethereum on Election Day 2016 would have yielded more than $25,000 by the next year. In the 2020-2021 election cycle, Bitcoin rose from $13,550 to $63,254, while an investment in Ethereum would have grown to over $10,000.

These patterns suggest that US elections can act as catalysts for upward movements in crypto prices, raising expectations about the potential for a bull run in 2024.

The 2024 US election is marked by stark contrasts in the candidates’ views on cryptocurrency. Former President Donald Trump has positioned himself as a strong advocate for digital assets, pledging to make the US the “crypto capital of the world.” Analysts speculate that if Trump wins, Bitcoin’s price could soar, with some forecasts suggesting it might reach six figures under a pro-crypto administration.

In contrast, Vice President Kamala Harris maintains a more cautious stance. While her administration is open to collaboration with tech leaders on blockchain innovation, it does not advocate for sweeping reforms. Although the president does not directly control the crypto market, the office wields significant influence over regulation through agencies like the SEC, CFTC, and the Treasury Department.

Historically, the US presidential election has had minimal direct impact on crypto prices. However, broader uncertainties, such as the collapse of the FTX exchange, have triggered significant market reactions. Despite this, the post-election period often reduces uncertainty, which can lead to a boost in crypto prices, regardless of the administration’s stance on digital assets.

Since their inception, Bitcoin and Ethereum have driven the growth of the crypto market, which has ballooned from zero in 2008 to a staggering $2.31 trillion today. While Bitcoin and Ethereum remain central to crypto trading, altcoins are also gaining traction. Coins like XRP, DOGE, and those associated with Trump, such as TRUMP and MAGA, are showing potential for massive rallies if Trump secures victory in the elections.

As the 2024 election approaches, expect increasing volatility in the crypto market. Investors are likely to react to polling results and campaign developments defensively, leading to significant market swings. Economic factors, including inflation and interest rates, will also play critical roles in shaping the crypto landscape.

US elections often lead to increased market volatility, with historical patterns showing significant price movements in cryptocurrencies like Bitcoin and Ethereum following election results. The outcome can influence investor sentiment, which may drive prices up or down.

In the 2016 election, Bitcoin surged from around $703 to over $7,141 within a year. Similarly, Ethereum saw a significant increase, with investments growing from $1,000 to over $25,000. In the 2020 cycle, Bitcoin rose from $13,550 to approximately $63,254, while Ethereum investments grew to over $10,000.