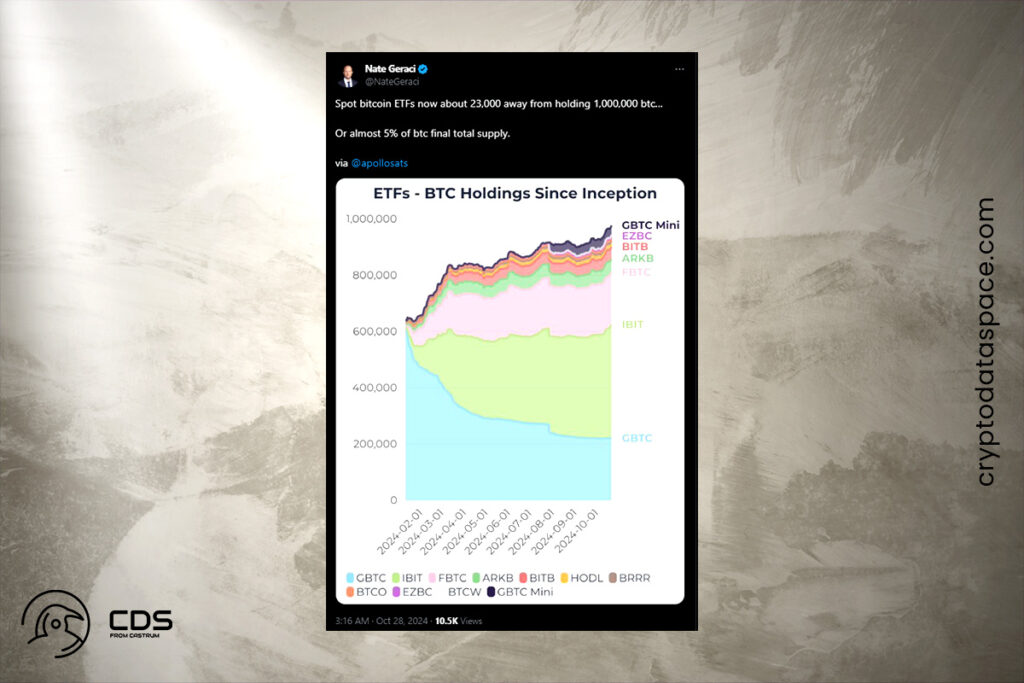

ETF expert Nate Geraci claims that the overall holdings of Bitcoin ETFs are currently close to one million Bitcoins. Together, they hold about 5% of the flagship cryptocurrency’s total supply. ETFs for Bitcoin saw inflows of $988 million last week.

The remarkable price recovery of Bitcoin has been accompanied by these positive ETF flows. CoinMarketCap statistics show that the flagship cryptocurrency is presently trading at $68,370. In contrast, just a small percentage of these inflows ($78.89 million) were drawn to spot Ether ETFs. Investor interest in these products remains quite low.

Data from SoSoValue indicates that BlackRock’s IBIT is now close to $24 billion. Out of all the ETFs introduced in the last four years, it is currently the one with the best inflow performance. With $14.72 billion and $12.42 billion, respectively, Grayscale’s GBTC and Fidelity’s FBTC rank second and third. Bitwise’s BITB and Ark Invest’s ARKB, with $2.65 billion and $2.28 billion, respectively, are also in the top 5.

In contrast, expert Eric Balchunas projected that by Christmas, Bitcoin ETFs would surpass the founder of the cryptocurrency, Satoshi Nakamoto, as the largest BTC holder. Notably, recent research indicates that retail investors account for the majority of demand for Bitcoin ETFs.

For more up-to-date crypto news, you can follow Crypto Data Space.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development