Bitcoin News – Bitcoin prices have experienced a significant drop of nearly 4% in the last 24 hours, falling from $72,500 to just above $69,000. This decline has contributed to an overall 5.5% decrease in the cryptocurrency market capitalization, indicating a broader market retreat.

The Fear and Greed Index, a crucial tool for gauging market sentiment, indicated “extreme greed” on Thursday, which historically suggests a potential market peak. By Friday, the index shifted to reflect “greed,” hinting that further price corrections might be on the horizon. This change in sentiment came as nearly 90% of futures positions were long, indicating a bullish outlook before the sharp correction occurred.

Bitcoin’s price decline is attributed to ongoing profit-taking ahead of the weekend. The cryptocurrency fell from $72,500 early Thursday to slightly above $69,000 by early Friday, erasing gains that had been accumulated since Monday. This correction resulted in the liquidation of over $250 million in bullish bets, as traders faced losses due to market volatility.

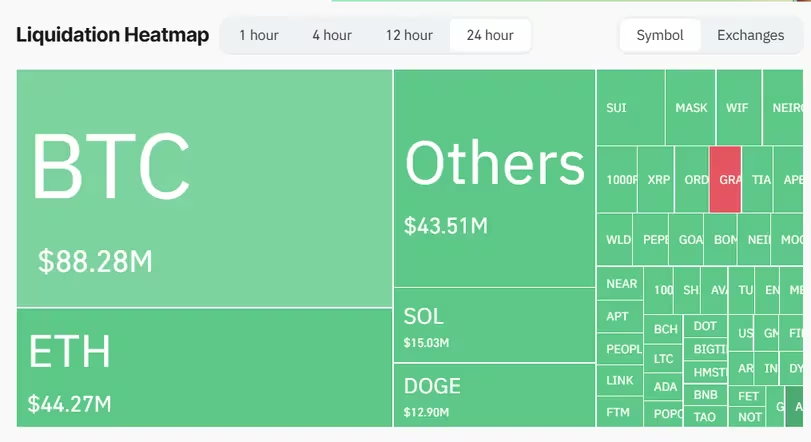

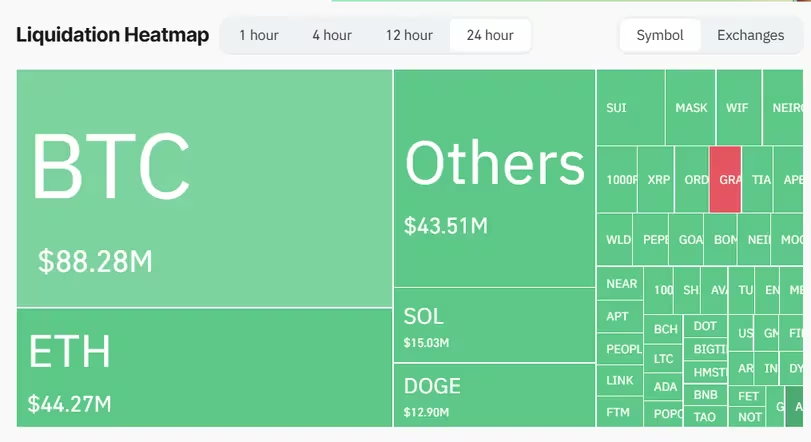

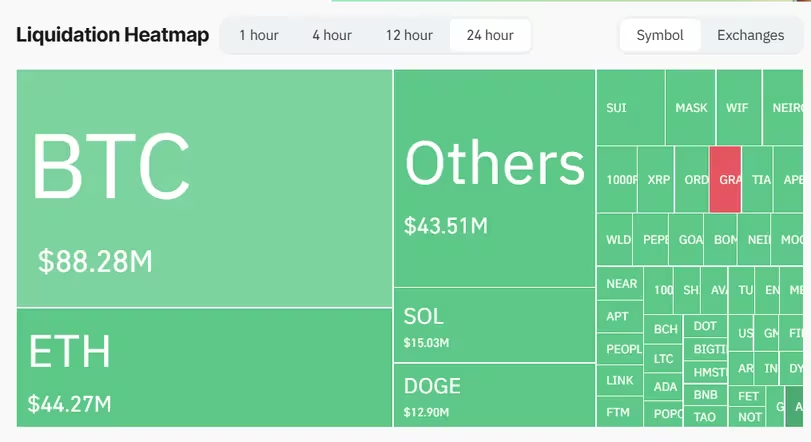

The market turmoil also affected futures traders significantly. Data from CoinGlass revealed that positions tied to Bitcoin futures suffered approximately $88 million in losses, while ether (ETH) futures recorded losses of $44 million. Additionally, futures related to SOL and DOGE each saw nearly $15 million in losses. This wave of liquidations underscores the precarious nature of the current market environment, as nearly 90% of all futures bets had been placed on anticipated price increases over the weekend, particularly with the upcoming U.S. elections on November 5.

Earlier this week, Bitcoin’s open interest reached record levels, exceeding $43 billion, but dropped to just above $41 billion early Friday. Such high levels of open interest indicate heightened trader activity and can amplify market volatility.

A liquidation occurs when an exchange forcibly closes a trader’s leveraged position due to insufficient margin requirements, often leading to panic selling or buying. The current liquidations may suggest a turning point in the market, where a price reversal could be imminent due to overreactions to market sentiment.

Despite the recent correction, some traders remain optimistic, targeting $80,000 for Bitcoin in the coming weeks. Factors such as global monetary policies and U.S. political support have contributed to the bullish sentiment observed in recent weeks.

In conclusion, while the recent price drop has caused discomfort for many traders, the overall market remains dynamic. Investors will be keenly watching the developments leading up to the U.S. elections, as market conditions continue to evolve. As always, caution is advised in these volatile times.

Bitcoin prices fell due to ongoing profit-taking as traders reacted to high market sentiment. The Fear and Greed Index indicated “extreme greed,” which often signals a potential market top, prompting traders to lock in profits before a possible correction.

The Fear and Greed Index measures market sentiment by analyzing various factors, including volatility, market momentum, and social media trends. Recently, it showed “extreme greed,” suggesting that the market may be overbought, which can lead to price corrections.

Futures liquidations occur when exchanges forcibly close leveraged positions due to margin call failures. This can lead to a cascade of selling, intensifying downward pressure on prices and increasing market volatility. Recent liquidations in Bitcoin futures surpassed $250 million, contributing to the price drop.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development