Bitcoin News – Since reaching its all-time high of $73,800, Bitcoin’s price has been consolidating within a wide range of $53,000 to $72,000. However, recent technical analysis suggests that this consolidation phase may be nearing its end, with a possible breakout on the horizon.

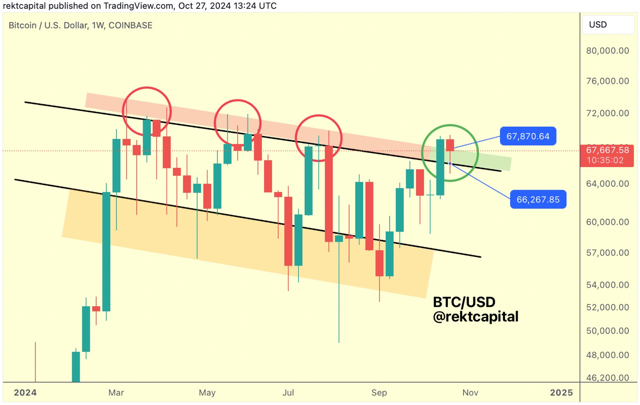

According to crypto analyst Rekt Capital, Bitcoin’s consolidation period could be coming to a close after achieving a bullish weekly close on October 27. In his analysis shared on social media platform X, Rekt Capital noted that Bitcoin was close to securing a weekly close above $67,900.

Data from Cointelegraph Markets Pro and TradingView confirmed that Bitcoin produced a bullish weekly close of $67,938 during this period, which Rekt Capital labeled a “bullish outcome.” He stated, “Bitcoin is once again getting very close to positioning itself for a more bullish outcome.” Historically, Bitcoin tends to peak between 518 and 550 days following a halving event, and Rekt emphasized that Bitcoin is currently about 35 days ahead in this cycle.

The anticipation of a breakout is further supported by Bitcoin’s volatility indicators, particularly the Bollinger Bands. Analyst Severino, known as “The Bull,” pointed out that the tightening conditions of the Bollinger Bands over a two-week timeframe indicate a significant “huge move” is imminent.

Currently, the width of the Bollinger Bands is among the three tightest instances recorded in history. The only other occasions when the two-week Bollinger Bands were this tight occurred in October 2023 and September 2015. During October 2023, the BTC/USD pair surged from approximately $26,500, rallying an impressive 180% to reach a high of $73,835 in March 2024.

In September 2015, a similar tightening preceded an astounding 8,300% rally, culminating in BTC reaching nearly $20,000 in 2017. If historical patterns hold, Bitcoin could soon break out of its current consolidation to reach unprecedented levels in the upcoming months.

Fellow analyst CryptoCon echoed this sentiment, noting that the tightening Bollinger Bands signal that a Bitcoin bull market may be on the horizon. He remarked, “This is one of the longest times spent in the Low Volatility Zone of the Weekly Bollinger Band Width.” The prolonged consolidation phase suggests that the longer Bitcoin stays in this pattern, the greater the potential upside.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development