Profit-taking occurred in the last 24 hours on the bitcoin markets following a robust week during which the largest cryptocurrency recorded a seven-day gain of about 6%. Bitcoin experienced a 0.5% decline before rising to slightly over $72,400. It reached a peak of $73,200 on Wednesday morning in Asia. The market-capitalization-based CoinDesk 20 (CD20), a liquid index of the biggest tokens, dropped 1.3% during the last day.

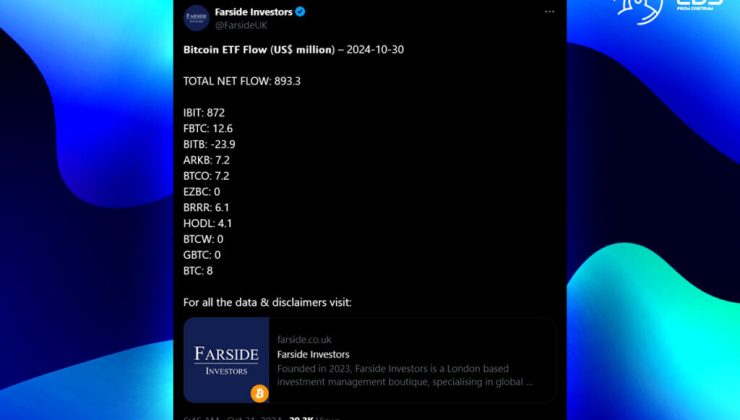

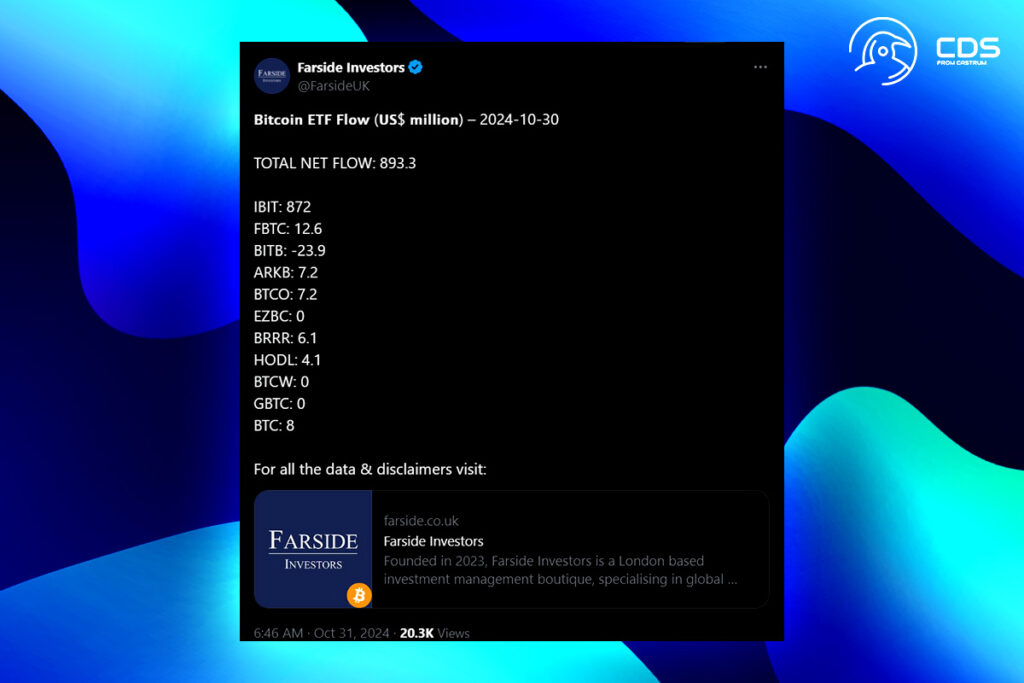

A market lull following a larger pump earlier in the week coincided with the second day in a row of robust inflows for U.S. bitcoin ETFs. The ETFs saw their first consecutive back-to-back inflows of over $850 million on Wednesday when they posted inflows of over $893 million after receiving $879 million on Tuesday. Wednesday’s flows were mostly driven by BlackRock‘s IBIT, which brought in a record $872 million.

As bitcoin’s dominance grows, traders said the net inflows are an indication of institutional demand.

Strong BTC net inflows indicate robust institutional demand as BTC dominance continues to rise (59.8%) at the expense of ETH. Equities are trading with a distinctive ‘Trump-win’ flavour despite official betting odds still calling for a 50–50 race. Similar positive skews can be observed in gold and crypto prices with call skews being bid up post-election as a hedge,

Augustine Fan, head of insights at DeFi platform SOFA

Skew is the term used to describe the form of a financial asset’s return distribution. In the context of an options market, positive skew, such as the price of gold and cryptocurrencies, signifies that call options are more in demand than put options. This indicates a rise in the number of investors purchasing options in anticipation of an increase in the asset price.

For more up-to-date crypto news, you can follow Crypto Data Space.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development