Crypto Market – Bitcoin has resumed its upward trajectory, reaching $68,500 early in European trading, as a recent surge in user activity and positive market sentiment bolsters the cryptocurrency landscape.

CoinDesk 20 Index: 2,079.56 (+2.23%)

Bitcoin (BTC): $68,574 (+2.37%)

Ether (ETH): $2,527.30 (+2.58%)

S&P 500: 5,808.12 (+0.03%)

Gold: $2,732.24 (-0.63%)

Nikkei 225: 38,605.53 (+1.82%)

Bitcoin has returned to $68,500 in early European trading, extending its rally that began on Sunday. After falling to a low of $65,700 late Friday, following reports from the Wall Street Journal about the DOJ investigating Tether for possible sanctions and anti-money laundering violations, Bitcoin quickly rebounded. Tether’s swift denial of the allegations helped stabilize the cryptocurrency’s price. Over the weekend, Bitcoin erased its losses, gaining over 2.4% in the last 24 hours and trading near $68,700.

In line with Bitcoin’s resurgence, both Ethereum (ETH) and Solana (SOL) have also recorded similar gains, contributing to an overall rise of over 2% in the broader crypto market, as measured by the CoinDesk 20 Index. Notably, DOGE, a popular memecoin, has seen a significant rebound, trading approximately 6% higher at over $0.145.

A recent research report from Steno Research suggests that MicroStrategy’s premium on its Bitcoin holdings is unsustainable. The introduction of options for spot Bitcoin ETFs is expected to reduce demand for MSTR stock, meaning the current 300% premium is unlikely to last. Historically, during the 2021 bull market, the premium was below 200% for most of the time. Analyst Mads Eberhardt noted that the positive effects of MicroStrategy’s recent 10:1 stock split are also waning. As regulatory attitudes toward Bitcoin and cryptocurrency become more favorable, investors may prefer holding Bitcoin directly instead of MicroStrategy shares, a trend that could continue if Donald Trump is re-elected.

On November 15, Hong Kong Exchanges and Clearing will launch a new virtual asset index series, administered and calculated by CCData, a UK-registered benchmark administrator and virtual asset data provider. CCData is owned by CoinDesk and will include reference indices for both Bitcoin and Ether. According to HKEX CEO Bonnie Y Chan, the initiative aims to provide transparent and reliable real-time benchmarks to help investors make informed decisions, further supporting the development of the virtual asset ecosystem and solidifying Hong Kong’s role as an international financial center.

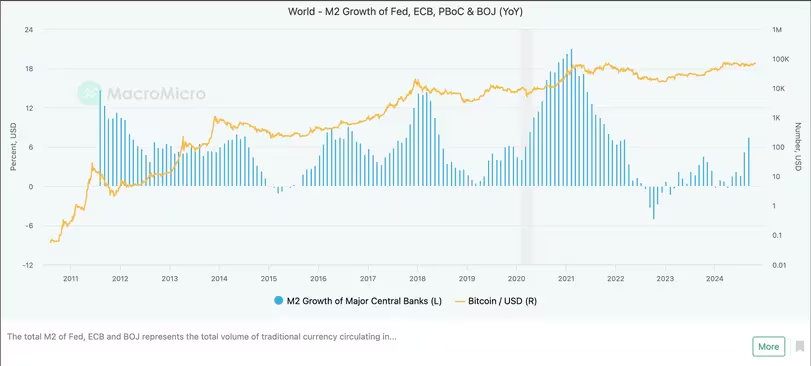

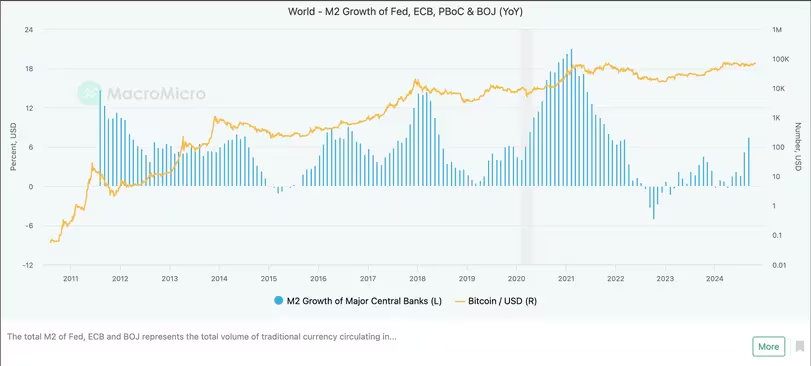

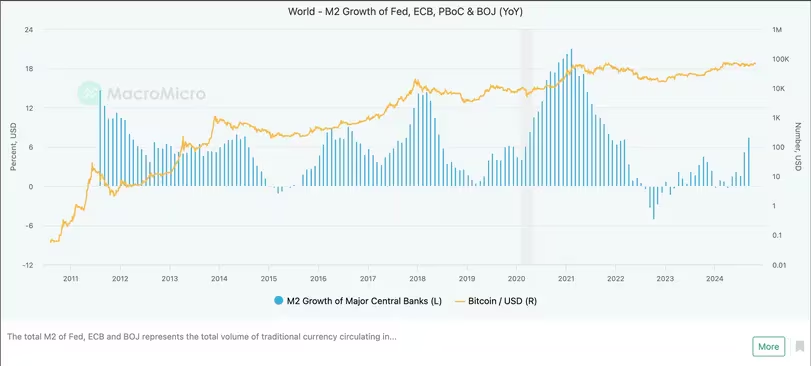

Recent data shows that the M2 money supply grew 7.5% last month, marking the fastest growth rate since November 2021. Historically, Bitcoin’s previous bull runs have been characterized by accelerated growth in the M2.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development