Crypto Market Rally– Recent data from Cointelegraph Markets Pro and TradingView indicates a notable rebound in Bitcoin (BTC) prices after the release of October’s nonfarm payrolls. The figures revealed a significant shortfall in job additions, with only 12,000 jobs created compared to the anticipated 106,000. Moreover, revisions for previous months were substantial, with September and August’s job numbers lowered by 31,000 and 81,000, respectively.

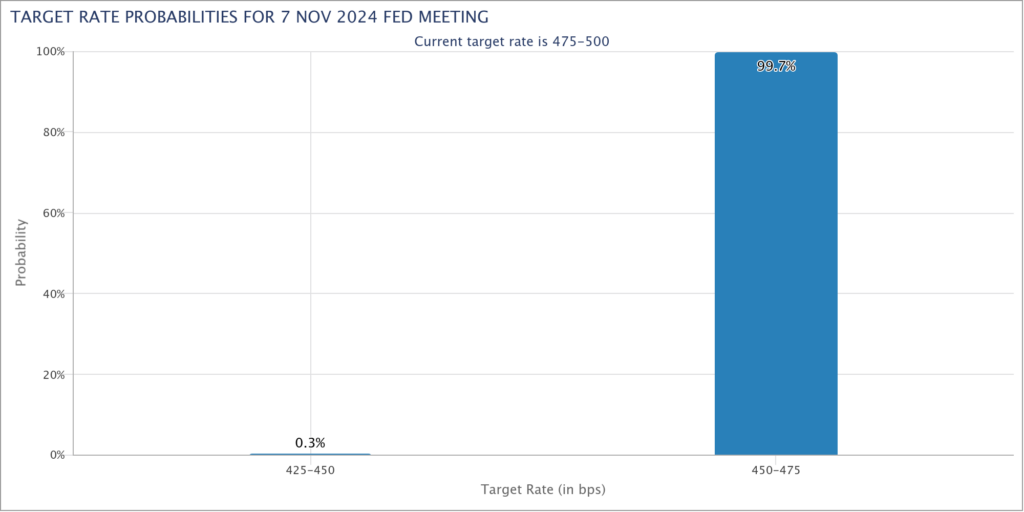

The unemployment rate remained stable at 4.1%, meeting expectations. The Kobeissi Letter commented on the data, stating, This marks the lowest number of US jobs added since July 2021. All signs continue to point toward a weaker labor market. Analysts from Kobeissi further anticipate that the Federal Reserve will cut interest rates by 0.25% in their upcoming meeting on November 7, a sentiment echoed by CME Group’s FedWatch Tool. Following the release of this data, the US Dollar Index (DXY) fell to 103.6 before making a slight recovery.

Crypto trader and analyst Michaël van de Poppe shared his insights on X, highlighting the negative impact of the nonfarm payroll results, which represent the worst performance since January 2021. Van de Poppe noted that easing economic conditions could signal a market reversal, stating, The reversal is around the corner as labor markets are getting softer. At the time of reporting, BTC/USD saw a 1.6% increase, surpassing $71,000 and triggering short liquidations.

Fellow trader Titan of Crypto identified $71,300 as a crucial support level to maintain momentum. He remarked, October’s candle close erased four months of downward price action in one go. Extremely bullish. The cloud also shows bullish signs, referring to his Ichimoku cloud analysis of the one-month chart.

The October jobs report showed that the U.S. economy added only 12,000 jobs, significantly below the expected 106,000. This disappointing data led to a rebound in Bitcoin’s price, pushing it above $71,000 as traders reacted to the potential for lower interest rates.

Analysts, including Michaël van de Poppe, predict a bullish reversal for Bitcoin as labor markets show signs of softening. With expectations of a potential interest rate cut by the Federal Reserve, Bitcoin’s price is positioned to benefit from looser economic conditions.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development