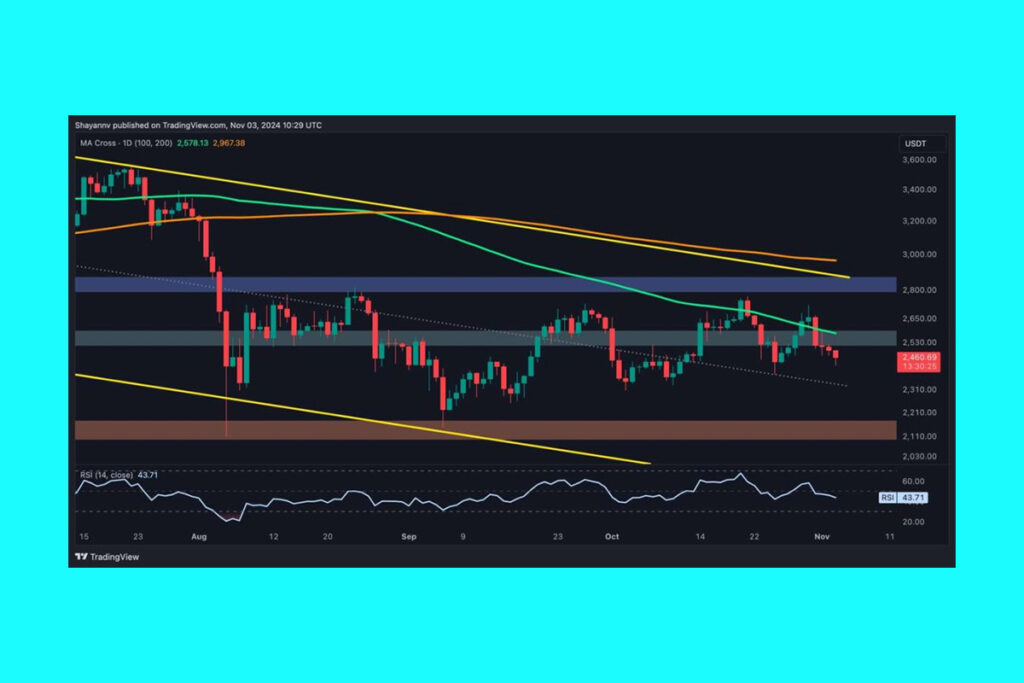

The latest price moves of Ethereum indicate a significant seller presence, especially in the vicinity of the 100-day moving average’s crucial resistance area. Increased downward pressure is indicated by this price movement, and a corrective consolidation is anticipated soon.

At the $2.6K resistance level, which corresponds to the 100-day moving average, Ethereum lately experienced increased selling activity. The asset was pushed back toward the dynamic support at the middle trendline of the channel, which is close to $2.3K, as a result of the rejection. The sellers’ presence at this resistance zone indicates that, at least in the medium term, it continues to be a major obstacle for buyers.

Significant selling pressure was applied to Ethereum’s recent rally on the 4-hour chart, which was centered on the resistance zone between the 0.5 and 0.618 Fibonacci levels ($2.6K-$2.8K). This region has acted as a robust barrier, suggesting a concentration of supply. A confirmed breakout and price activity around this zone will determine a change toward a bullish trend.

At $2.4K, Ethereum is currently holding close to the flag’s bottom threshold. The price may move toward $2.1K if this support is broken since this might set off a chain reaction of liquidations. The more likely scenario, though, is a period of consolidation around this support level, during which ETH can rise again toward the 0.5 Fibonacci level until a clear breakout takes place.

The price of Ethereum has been settling into a small range, indicating that the market is unsure. However, according to futures market data, a breakout would trigger a significant liquidation event, which would probably intensify the current trend. The chart indicates that liquidity has consolidated below the $2.4K mark, indicating that this price range could be crucial shortly. A downward breakdown might draw more selling and force long-term purchasers to exit their positions, escalating the bearish trend, according to significant liquidity pools below $2.4K.

The price of Ethereum may drop to the $2.1K support level as a result of a series of liquidations in a long squeeze scenario. For sellers, the $2.4K range is a desirable price reduction level. On the other hand, purchasers’ activities at this level will be significant in deciding the overall market trend, making it a vital line of defense. In the end, Ethereum’s price action around the $2.4K mark will determine the short-term trend; any movement outside of this range may indicate a more significant change in direction.

For more up-to-date crypto news, you can follow Crypto Data Space.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development