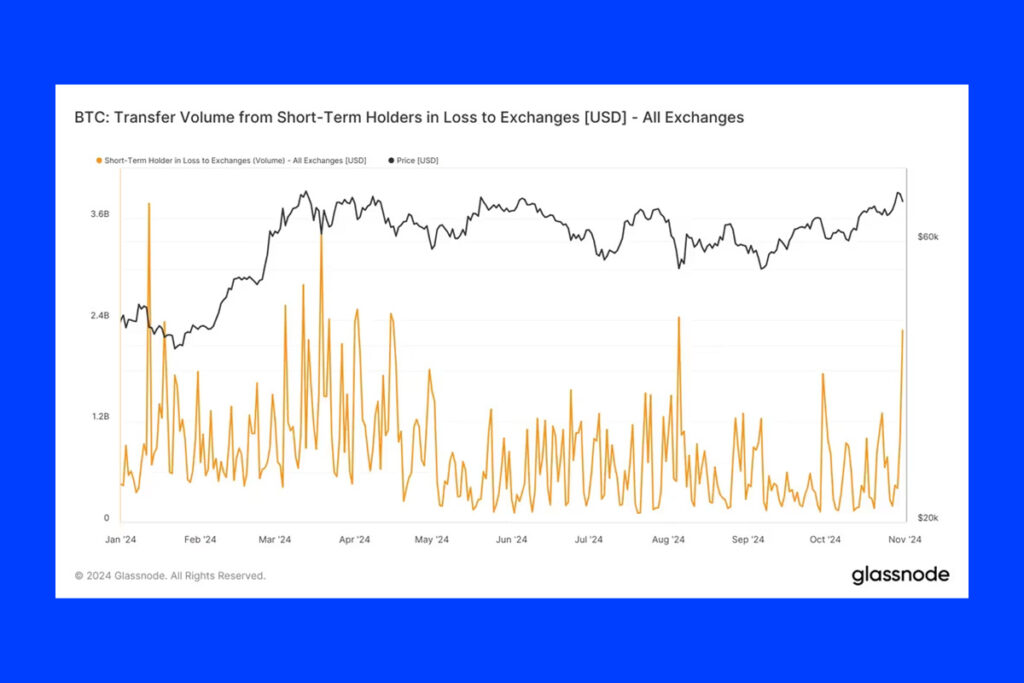

The price of bitcoin fell below $70,000 on Thursday after hitting an all-time high earlier in the week, sending around $2.3 billion, or some 32,000 tokens, of the largest cryptocurrency to exchanges at a loss. Since the yen carry trade ended on August 5, the panic selling has been the worst. In times of market exuberance or greed, short-term holders typically buy, and when the price declines, they panic and sell. They transmitted the most Bitcoin to exchanges since March 27 on Thursday, sending almost 54,000 BTC in total.

Numerous causes could be contributing to the recent decline, which has brought Bitcoin down roughly 6% from its peak. On November 5, investors will likely reduce their risk exposure, as they usually do on the last day of the month, in anticipation of the U.S. presidential election. On Thursday, the US stock market lost nearly $1 trillion, and the magnificent seven tech stocks all turned red.

CoinDesk data, which breaks Thursday’s 54,000 bitcoin into profit and loss, indicates that profit-taking is still going strong as the cryptocurrency gets closer to its record high from March. Over the last three days, more than $6 billion worth of bitcoin has been sent to exchanges in profit, including 22,000 BTC on Thursday. Last month, Bitcoin increased by 11%.

For more up-to-date crypto news, you can follow Crypto Data Space.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development