A stronger-than-expected September jobs report has significantly shifted the conversation around the Federal Reserve’s potential interest rate cuts in November. With robust labor market data, Wall Street analysts are now leaning toward a more modest cut or even no rate cut at all.

Many experts had anticipated a more aggressive stance, but the new data has sparked a reconsideration. Paul Ashworth, Chief North America Economist at Capital Economics, commented, “Given the strength of September’s employment report, the real debate at the Fed should be whether to ease monetary policy at all. Any hopes for a 50 basis point cut are long gone.”

Markets now pricing in just a 5% chance the Federal Reserve cuts interest rates by 50 basis points in November, down from a 53% chance seen a week ago, per the CME FedWatch Tool.https://t.co/TLh1L5Kgpu pic.twitter.com/xZTPu5yOIG

— Josh Schafer (@_JoshSchafer) October 4, 2024

Following the report’s release, market expectations for a 50-basis-point cut dropped dramatically. According to the CME FedWatch Tool, the likelihood of such a move fell to around 8%, down from 53% just a week prior.

Gregory Daco, Chief Economist at EY, noted that the jobs report reinforces the Fed’s likely decision to hold off on significant rate cuts. “This data should bolster the view among Fed officials that there is no rush to reduce interest rates,” he wrote. Daco also suggested that some Fed members might favor a pause in cuts altogether.

Before the release, markets were largely debating whether the Fed would deliver another sizable rate cut, with some speculating that a jumbo-sized reduction might be necessary due to signs of labor market cooling. However, Friday’s data showed no such slowdown.

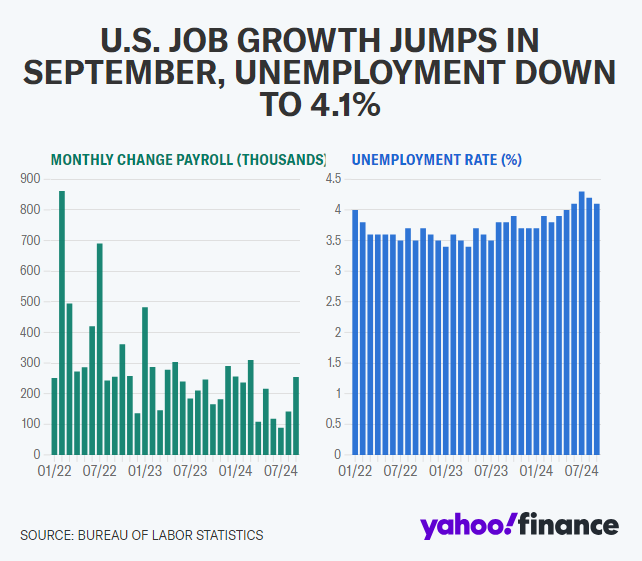

The Bureau of Labor Statistics reported that 254,000 jobs were added in September, significantly exceeding economists’ forecast of 150,000. Revisions to the July and August figures added another 72,000 jobs to the previous totals, further indicating strength in the labor market. The unemployment rate also dropped to 4.1%, down from 4.2% in August.

This positive news aligns with Fed Chair Jerome Powell‘s recent comments. In a press conference on September 18, Powell remarked that the labor market remains solid. “The U.S. economy is in good shape, growing at a solid pace. Inflation is coming down, and the labor market is strong. Our goal is to maintain this strength while gradually adjusting rates,” he said.

Despite the strong jobs report, some experts, like Kathy Bostjancic, Chief Economist at Nationwide, still expect the Fed to follow through with rate cuts, albeit at a slower pace. Bostjancic believes the Fed will implement two more 25-basis-point cuts before year-end, as outlined in the central bank’s latest Summary of Economic Projections (SEP).

“The FOMC wants to lower the policy rate from a position of strength in the labor market, and today’s report suggests they can do that while keeping the economy moving forward,” Bostjancic wrote in a note to clients.

Morgan Stanley’s Global Chief Economist, Seth Carpenter, echoed this sentiment, predicting that the Fed will proceed with 25-basis-point cuts at both the November and December meetings. “Chair Powell’s baseline is to continue with gradual cuts, and this report shows a rebound from the summertime softness in the labor market,” Carpenter noted.

With broad signs of economic resilience, the upcoming Federal Open Market Committee (FOMC) meetings will be closely watched as officials balance the dual mandate of price stability and maximum employment.

1

Wall Street Awaits AI Payoff as Tech Giants’ Capex Soars Ahead of Fall Earnings

1

Wall Street Awaits AI Payoff as Tech Giants’ Capex Soars Ahead of Fall Earnings

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

Relative Strength Index (RSI): A Comprehensive Guide to Understanding and Using This Indicator

3

Relative Strength Index (RSI): A Comprehensive Guide to Understanding and Using This Indicator

4

DSG Investments Completes Autodrom Investment

4

DSG Investments Completes Autodrom Investment

5

Gate.TR Achieves 559% Growth in Its Second Year in Turkey

5

Gate.TR Achieves 559% Growth in Its Second Year in Turkey

[…] this summer was defined by the return (or rather the lack) of AI-driven ROI, Wall Street is now gearing up for tech’s fall earnings with mixed expectations. Despite the surge in […]