Turkish Investors – A recent survey conducted by the cryptocurrency exchange Paribu has highlighted a significant shift in investor preferences in Turkey, indicating that more individuals are favoring cryptocurrencies over traditional investment avenues such as real estate and stocks.

The 2024 Cryptocurrency Awareness and Perception Survey aimed to provide insights into the evolving landscape of Turkey’s crypto ecosystem. The survey included 2,002 interviews with individuals familiar with cryptocurrencies and 541 interviews with active traders. The primary objective was to assess the nation’s awareness and perception of cryptocurrencies while identifying the expectations, motivations, and barriers associated with digital assets.

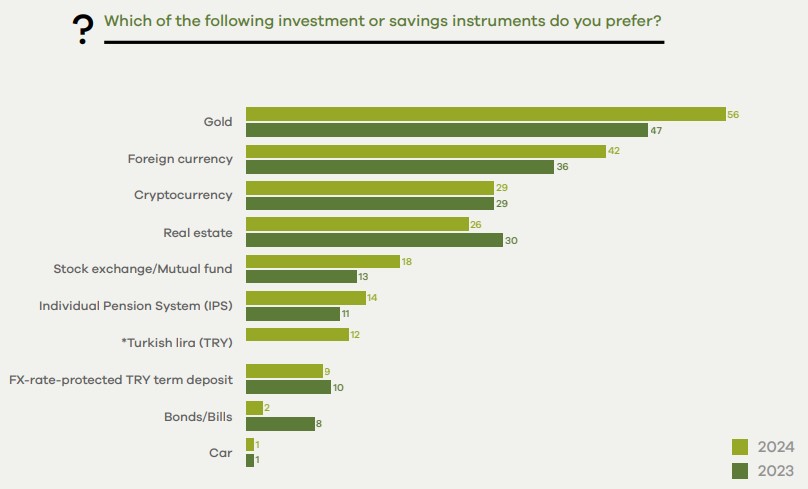

When participants were asked about their preferred investment options, 56% identified gold as their top choice for saving or investing. Foreign currency ranked second, followed by cryptocurrency, which was preferred by 30% of investors. Interestingly, in 2023, participants had shown a preference for real estate over cryptocurrencies, with 30% favoring real estate. However, this preference has decreased to 26% in 2024, elevating cryptocurrencies above this traditional investment option. Although the preference for stocks and mutual funds increased from 13% in 2023 to 18% in 2024, it still lags behind real estate.

Nergis Nurcan Karababa, the research content manager at Paribu, explained that several factors contribute to the rising interest in cryptocurrencies. Transaction speeds, accessibility, and the high return potential of crypto assets are significant drivers encouraging users to participate in this market. Karababa noted:

“Compared to traditional financial products, crypto assets may experience much higher rates of adoption. Individuals are motivated to step into this world now, anticipating more widespread use in the future.”

She further emphasized that the increasing interest from institutional investors bolsters this trend.

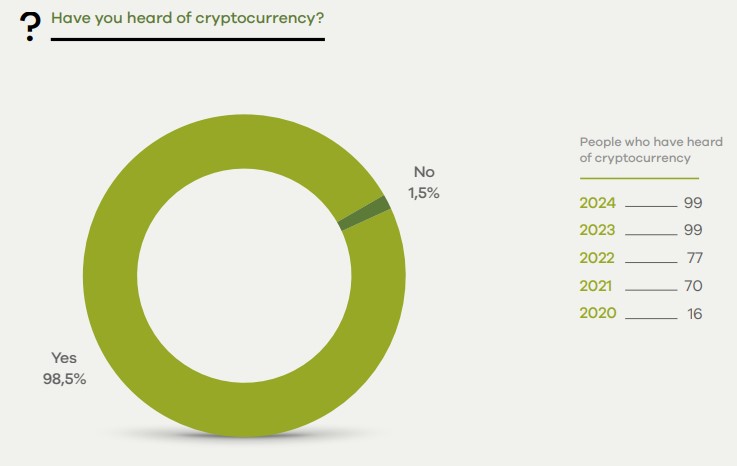

The survey revealed that nearly 99% of respondents have heard of cryptocurrencies, a remarkable rise from 16% in 2020. Awareness increased to 70% in 2021, likely spurred by a surge in crypto market capitalization, which reached $3 trillion in November 2021. By 2022, awareness climbed to 77%, maintaining the 99% figure in both 2023 and 2024.

Despite high levels of awareness about cryptocurrencies, a significant knowledge gap exists regarding blockchain technology. The survey indicated that 72% of respondents were unaware of blockchain, although awareness is gradually improving. In 2023, 25% of respondents recognized blockchain technology, a 3% increase from the previous year. Among those aware of blockchain, 67% understand that it is utilized in cryptocurrencies.

Karababa explained that while cryptocurrencies are viewed as investment tools, blockchain technology is often perceived as a complex infrastructure rather than an accessible product. She stated:

“The disparity in awareness likely stems from the distinct positioning and visibility of cryptocurrencies versus blockchain technology in the public sphere.”

Furthermore, she noted that applications of blockchain outside of the crypto sector are still relatively niche, lacking widespread public resonance. As a result, many individuals may engage with cryptocurrencies despite being unaware of the underlying technologies.

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

1

Memecoins Surge as “Peanut the Squirrel” Becomes a Viral Icon in Solana’s DeFi Market

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

2

Strong September Jobs Report Alters Fed Rate Cut Expectations

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

3

The Future of Financial Reporting: Crypto News and Emerging Trends in Digital Assets

4

Crypto Landscape: Job Cuts Amid Financial Gains

4

Crypto Landscape: Job Cuts Amid Financial Gains

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

5

Ethereum Researcher Justin Drake Steps Down from Eigen Foundation, Signals Full Commitment to Layer-1 Development

[…] Wyndham Grand Istanbul Levent. The conference will explore the future of financial technologies in Turkey alongside global trends. Sessions will cover topics like crypto regulations, bull markets, digital […]